Vestager’s next big fight will be with Europe

Margrethe Vestager was running late.

The Danish politician, recently installed on the 12th floor of the European Commission’s Berlaymont building to oversee Europe’s digital agenda, had just finished a meeting with her staff. Next up, a meet-and-greet with a Polish minister. In the days before, she had fined NBCUniversal €14.3 million for breaking the region’s competition rules and unveiled guidance on limiting the bloc’s dependence on Chinese telecoms equipment.

“This combination of regulation and freedom in our social market, that has made us prosperous,” the European Commission’s executive vice president for digital, 51, told POLITICO, moving away from her cluttered desk, stacked high with documents, while taking a sip of tea — her drink of choice after giving up coffee last year. “It works, let’s do that and let’s do more.”

These days, Vestager is in full sales-pitch mode.

After years as arguably the world’s most high-profile tech enforcer, the Dane is now confronted with changing political winds in Brussels that have suddenly turned against her.

A long-standing cheerleader for open markets, she is facing increased clamor from across the European Union for policymakers to more aggressively promote the region’s digital interests — a battle that will be felt well beyond the bloc as Brussels continues to set standards in how to police the world’s online economy.

In the coming weeks, the Commission will outline its stance on everything from how artificial intelligence should be regulated to how reams of European data — drawn from the region’s industrial powerhouses like Siemens and Telefonica — can be collected, stored and used to boost the digital economy. Revamped competition rules, driven by concerns over a few digital giants dominating much of the online world, are also in the works.

Vestager’s new mandate, as both the EU’s top antitrust enforcer and its champion for industrial policy, will be central to Brussels’ renewed efforts to lay down its claim on the global stage. But questions are already circling about how far Vestager is willing to put this “Europe First” strategy into practice — and whether she can navigate the new political reality.

Led by Ursula von der Leyen, the newly appointed Commission president, the EU is trying to get its groove back, proclaiming a new “geopolitical” ethos aimed at putting the Brexit blues behind the 27-country bloc and competing head on, particularly in the tech sector, with the likes of the United States and China.

But sitting at a long desk in her Berlaymont office, surrounded by paintings, including a pop art depiction of 1940s film star Rita Hayworth, Vestager argued that Europe’s beefed-up posturing was not about protecting, or promoting, national industries at the expense of foreign rivals.

Yes, Europe is now more willing to defend its own interests, she said. But not at the expense of undermining the bloc’s long-standing rules of open markets and fair competition.

“If you want to be a global champion, then you have to be competitive,” she said, dismissing accusations from both tech executives and U.S. President Donald Trump that Europe is out to coddle its own firms against much larger U.S. and, increasingly, Chinese competitors.

“If you were cushioned and coddled in your home market and you just can pass on costs to consumers, well, it’s highly likely that you will not be able to make it in global markets,” she added.

Franco-German push

Not everyone in Brussels shares Vestager’s philosophy.

In more than a dozen interviews with senior Commission officials, all of whom spoke to POLITICO on the condition of anonymity because they were not authorized to speak publicly, a picture emerges of a battle raging within the Berlaymont over how far Europe should go to stamp its mark on new digital industries — and how willing Vestager will be to use all the levers at the EU’s disposal to make that happen.

Ever since the new Commission took over in late 2019, there has been a push — primarily led by France and Germany — to be more assertive in intervening on behalf of local firms, including tipping the scales in favor of national champions in strategically important industries like cloud computing and autonomous vehicles, these officials said.

That also includes efforts to rewrite competition rules to allow megamergers like the proposed link-up between Alstom and Siemens, the French and German rail giants, that Vestager blocked last year. Data — the lifeblood of the digital economy — has also become a political football, with opposing sides dueling over who should have access to the digital information that will likely determine who wins in globally important technologies like artificial intelligence, next-generation mobile networks and quantum computing.

“We’re under pressure to make things happen,” said one official, who referred to a growing pushback within the “deep Commission,” or the rank-and-file civil servants, against what many considered proposals that ran against the EU’s underlying treaties. “Of course, Europe should lead the way. But we don’t want to be taking our marching orders from Paris or Berlin.”

In a sign of the pressure on Vestager, four leading EU countries warned her this week to hurry up in reforming competition rules to allow the creation of European champions to rival China and the U.S.

While the Danish commissioner has set out a long-term time frame for changes to competition law, France, Germany, Italy and Poland said that they wanted to see an action plan within weeks.

Click Here: pinko shop cheap

For her part, Vestager — as ever, the canny political operator, accustomed to using popular culture references, selfies and other gimmicks to appeal to ordinary EU citizens — is guarded about how far Europe should go to push its claim.

Asked repeatedly about elements of the Commission’s “geopolitical” approach, she framed any changes as more evolutionary than revolutionary, arguing that maintaining a level playing field between local firms and foreign rivals would remain her guiding principle.

“As long as there’s someone else that you can turn to, that is perfectly fine,” she said in reference to renewed EU efforts to create regionwide champions. “Those can be Chinese, American or South American.”

Still, Vestager did not become one of the Commission’s top officials without reading the political tea leaves. And as the beating drums grow louder for more aggressive regulatory action to promote EU interests, she’s shown herself willing to embrace some of these policies, even as she claims any changes are merely about keeping global markets honest.

While still a defender of the EU’s liberal principles, she also said the bloc should be willing to push back against state-funded foreign companies from buying European competitors if prices for such deals were either artificially inflated or deflated — takeovers, the Dane argued, that may fall afoul of the region’s strict state-aid rules.

Similarly, international companies are free to bid for EU projects, funding that represents hundreds of billions of euros of public money each year. But only if European companies can also pitch for state-backed initiatives outside the bloc, arguably a warning to how China often limits which firms can compete in its massive domestic market.

“You’re welcome to come here and bid,” said Vestager. “But then we would like to be able to come to your market and be part of your procurement process.”

She depicted Europe’s more overtly interventionist policies — including earmarking €3.2 billion of EU funds in December to support battery-makers from seven member countries to develop world-leading technology — as more about jumpstarting markets, not defending the region’s companies.

Vestager argued this recent announcement, including funds provided to European heavy-hitters like the German chemical producing giant BASF and automotive giant BMW, was filling a gap that companies alone could not fill, and that the public money invested would ignite private investment that would eventually benefit EU citizens.

“These are solutions that the market, by itself, would not give us, even if we were looking to markets outside Europe,” she said, when asked if the support for Europe’s battery industry amounted to unfair state aid. “You know, I feel 100 percent justified.”

Want more analysis from POLITICO? POLITICO Pro is our premium intelligence service for professionals. From financial services to trade, technology, cybersecurity and more, Pro delivers real time intelligence, deep insight and breaking scoops you need to keep one step ahead. Email [email protected] to request a complimentary trial.

You May Also Like

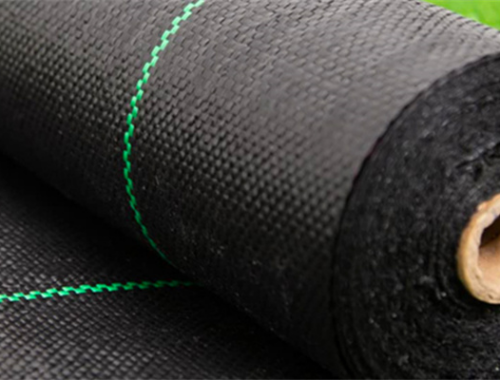

FACTORS AFFECTING THE SERVICE LIFE OF GEOTEXTILES: DURABILITY AND MAINTENANCE

December 9, 2024

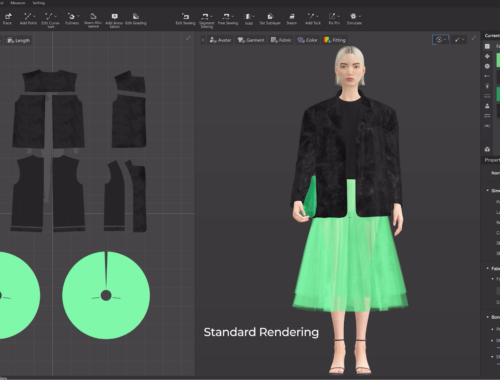

AI in Fashion: Revolutionizing Design, Sustainability, and Shopping Experiences

February 28, 2025