US Treasury slams EU tax probes ahead of possible Apple verdict

Does Apple’s tax arrangement with Ireland violate EU "state aid" rules? | Carl Court/Getty Images

US Treasury slams EU tax probes ahead of possible Apple verdict

The move comes ahead of a possible Commission decision on whether Apple’s tax arrangement with Ireland violates EU “state aid” rules.

The Treasury Department upped the ante in a growing U.S.-EU corporate tax battle Wednesday, slamming the European Commission’s tax investigations into multiple U.S.-based companies and taking the unusual step of releasing a 26-page white paper detailing its concerns.

The Treasury paper reflects an unprecedented attack on a spate of European competition investigations involving transfer pricing and U.S. companies. The aggressive U.S. move came ahead of a possible Commission verdict this fall on whether Apple’s tax arrangement with Ireland violates EU “state aid” rules.

In a blog post accompanying the white paper, Deputy Assistant Treasury Secretary for international tax affairs Robert Stack said if the Commission required U.S.-based companies involved in the probes to pay retroactive taxes to European governments, it “could create an unfortunate international tax policy precedent” and have “an outsized impact on U.S. companies. Furthermore, it is possible that the settlement payments ultimately could be determined to give rise to creditable foreign taxes. If so, U.S. taxpayers could wind up eventually footing the bill for these State aid recoveries in the form of foreign tax credits that would offset the U.S. tax bills of these companies.”

Stack warned that the Commission’s use of state aid rules to go after alleged tax avoidance “is new and was unforeseeable by the relevant companies and EU Member States. … We emphasize that the Commission should not seek to impose recoveries under this new approach in a retroactive manner because it sets a bad precedent for tax policymakers around the world. Finally, we explain that the Commission’s approach undermines U.S. tax treaties and international transfer pricing guidelines already accepted broadly in the global tax community, and undermines the work done as part of the [OECD Base Erosion and Profit Sharing] project.”

The white paper follows a meeting between Treasury Secretary Jack Lew and European competition chief Margrethe Vestager earlier this summer in Brussels, and a letter from Lew to Vestager on the matter.

The Commission has already ruled that Starbucks’ tax deal in the Netherlands violated EU rules, and it is also probing Amazon’s tax arrangement in Luxembourg.

Previous disagreements, over the Commission blocking a proposed merger between GE Honeywell a decade ago for example, resulted only in brief public rebukes.

“There is no bias,” said Lucia Caudet, a European Commission spokesperson, adding, “All companies, no matter their nationality … should pay taxes in line with national tax laws.”

Ricardo Cardoso, a spokesman for the Commission, told POLITICO in early August in response to similar allegations that “EU competition rules, including state aid rules, apply to all companies operating on the EU’s single market, large or small, irrespective of whether they are EU companies or originate from outside the EU -— there is absolutely no bias against US companies.”

Some within the Commission are more explicit, suggesting Apple has donated to Democrat politicians in the past and that the U.S.’s Democrat government is now campaigning on its behalf.

That seems doubtful: Unlike other big tech firms, Apple has not set up a political action committee to fund politicians’ campaigns.

A previous version of this story implied that the Treasury white paper referred to just one EU competition case; it actually reflects Treasury’s view on a series of cases.

Click Here: Italy Football Shop

You May Also Like

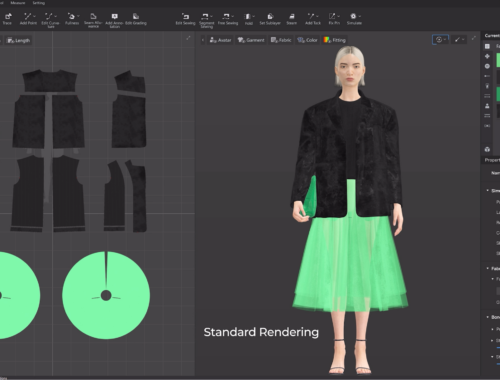

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Automatic Weather Station: An Overview of Its Functionality and Applications

March 14, 2025