Trump's Tariffs Could Make Made-in-the-USA Gear Pricier

>

Last week, President Trump announced tariffs on most imported steel and aluminum (25 percent on the former and 10 on the latter), which go into effect on March 23. So what's that mean for the price of your favorite camping stove, skis, or bike—and the companies that make those products?

In short: It depends on where the gear comes from. Many U.S. outdoor brands manufacture their products overseas, then import the finished goods. These companies should remain unaffected by the tariffs, which only apply to the raw metals. Of course, imported bikes, skis, outdoor apparel, and the like are already subject to high import tariffs, but those won't increase as a result of Trump's recent ruling.

It's brands that make their goods in the U.S. that stand to take a financial hit, whether they source their metals at home or overseas.

Joseph Daniels, chair of the Marquette University Economics Department, predicts that the tariffs will drive up the domestic cost of steel and aluminum because of increased demand. In past studies on steel, the cost of the raw material rose a third of the total tariff amount, says Daniels. “Foreign producers will pass on some of the costs of the tariff to U.S. consumers, but not the full amount,” he says.

Daniels couldn't say exactly how much domestic costs will go up or how brands that manufacture in the U.S. will respond. Many brands are still unsure of exactly how they'll be affected. However, across the industry, there seems to be a mutual sense of foreboding, as bike, ski, and camping-gear makers anticipate costs to rise.On Tuesday, March 13, Rich Harper, the Outdoor Industry Association's manager for international trade, wrote in an email that the tariffs "would lead to higher costs for outdoor products produced domestically that utilize steel and aluminum imports, like camping stoves, tent poles and skis and snowboards."

Paul Sadoff, who runs Rocklobster, a custom-bike maker in Santa Cruz, California, says he expects his costs to increase “an additional $2,500-3,000 annually,” if his suppliers pass along the full tax increases on imported steel and aluminum. Sadoff’s company specializes in steel and aluminum frames, and sources roughly half of its materials from within the U.S. “There is very little margin in hand-made bicycle frames, so any additional costs eat into an already minuscule bottom line,” he says. “It is not easy to make a living at what I do, so this latest tariff is an unwelcome development.” He anticipates that any significant cost increases will get passed on to the consumer.

American-based ski companies have no choice but to import their steel ski edges, as there currently aren't any manufacturers producing it domestically. Ski company Moment manufactures its products in the U.S. but sources steel from Germany. “Steel edge is used in every single ski and a 25-percent increase is large,” says CEO Luke Jacobson. Jacobson predicts the tariff will raise Moment's cost-per-ski by less than $1, though "every penny counts when you're running a business," he says.

It's not just boutique gear makers that are worried. Take MSR. Between stoves, camp-kitchen equipment, avalanche safety gear, tents, and snowshoes, the Seattle-based company uses a lot of steel and aluminum in its products. According to a spokesperson, a large percentage of that metal comes from within the U.S. So while the brand says it expects "the short-term impact to be relatively low,” it is bracing for higher costs down the line. The company could not pin down how much it anticipates costs rising, but said it will "work to minimize or eliminate the effect that increased material costs have on customer prices."

The tariffs could incentive brands to stop making their goods in the U.S. and start outsourcing manufacturing to another country. According to David Kuenzel, an assistant economics professor at Wesleyan University, “U.S. producers that use steel or aluminum will be put at a comparative disadvantage to producers in other countries.” With costs of both imported and domestically produced steel and aluminum expected to rise, U.S.-based brands will face a financial incentive to ship their manufacturing overseas.

In the meantime, Harper, of the OIA, has put out a call for outdoor brands to "email me with your thoughts on the president’s tariffs and how it impacts your business." Harper and his colleagues are making sure outdoor companies are apprised of the latest developments and are "keeping eye on other countries, to see if they put together their own retaliatory list of tariffs," which the EU has already threatened.

If costs of domestic manufacturing do rise, it'll be largely up to consumers to support companies that decide to keep their manufacturing stateside.

7 Beginner-Friendly Ultramarathons

You May Also Like

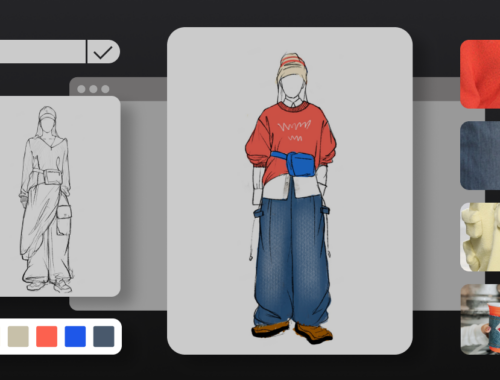

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Google Snake Game: A Classic Arcade Experience

March 23, 2025