Transat To Lay Off Thousands By 2021 If There’s No Help For Airlines

MONTREAL — Transat AT Inc. expects to permanently lay off at least 2,000 Canadian employees after revenues fell 99 per cent last quarter, when the travel company operated flights for just one week.

Click Here: camiseta rosario central

The layoffs would reduce Transat’s workforce by about 40 per cent and likely come after the end of the federal wage subsidy — scheduled to expire Dec. 19 — “if the situation does not improve rapidly,” CEO Jean-Marc Eustache said on a conference call.

Nearly two-thirds of Transat’s 5,100 workers in Canada already have been temporarily laid off, he said.

The announcement Thursday came alongside dire financial results, as the company saw net losses surge to $45.1 million in its third quarter from a loss of $1.5 million in the same period a year earlier. The recent losses are more than 50 per cent below analyst expectations.

The Montreal-based tour operator grounded its planes between April 1 and July 22, leaving only nine days for flights to occur at the tail end of the quarter, unprecedented in Air Transat’s 34-year history.

‘We are frustrated’

“The situation is especially difficult in Canada. Restrictions at the border are particularly stringent, with the closure to foreigners and mandatory quarantine for Canadians coming back from any other country at least until Sept. 30,” Eustache said, echoing comments made by other airline CEOs.

“We are frustrated.”

The $720-million Transat acquisition proposed by Air Canada also looks increasingly uncertain, the company suggested.

Airlines across the globe have reduced capacity, leaving a transformed market that could impact regulatory approvals, “especially regarding the appropriate package of remedies aimed at obtaining those approvals,” the company said in its release.

Discussions around new financing for Transat are at “an advanced stage,” Eustache said. But borrowing options remain an issue as Air Canada may have veto power over further loans or credit under the terms of their agreement, he said.

“Although the agreement provides that Air Canada’s consent may not be unreasonably withheld, there is no certainty that Air Canada will consent to the obtaining of additional sources of financing by the corporation,” the company said.

Watch: Airlines are redoubling their efforts to clean cabins. Story continues below.

Transat shares closed at a new low for the year of $4.96, more than 70 per cent below the $18 per share Air Canada pledged in its takeover bid.

European regulators are expected to reach a decision on the deal by Dec. 11. The Trudeau government has not yet announced a thumbs-up or -down, which “may come at any time,” Eustache said.

“With the EU investigation pushed out to mid-December and a deal deadline of Dec. 27, there is concern that the transaction may not close,” Laurentian Bank Securities analyst Mona Nazir said in a research note.

“Furthermore, should Air Canada remain interested in Transat from a strategic and financial perspective, it is possible that a lower offer may be made.”

Air Canada declined to comment on the deal until the regulatory approval process is complete.

Transat operations remain severely curtailed. It is now flying out of 18 airports in Europe, the Caribbean and, domestically, in Montreal, Toronto, Calgary and Vancouver.

The company bled about $1.7 million in cash per day in the quarter ended July 31, but still had $576.4 million in cash and cash equivalents as of that date.

RELATED

- Air Transat Planning To Resume Flights On July 23

- Air Canada Loses $1 Billion In A Single Quarter Due To Pandemic

- Air Transat Slashes 70% Of Workforce As Airlines Take A Hit With COVID-19

Class action lawsuits and reimbursement rules add another financial drain on the carrier’s coffers after Transat, like other Canadian airlines, issued flight credits rather than refunds for trips cancelled due to the COVID-19 pandemic.

“This exposes the corporation to litigation and enforcement measures by legislative and regulatory authorities, including class action suits, which the corporation intends to contest in good faith and with good reason,” Transat said.

Retaining passengers’ cash for services never rendered has bolstered Transat’s balance sheet for the time being, with travel credit making up $564 million or 88 per cent of its $638.1 million in customer deposits.

Passengers have filed a handful of proposed class-action lawsuits against airlines and three petitions garnering more than 109,000 signatures call for customer reimbursement. Meanwhile, Transat has announced it will offer refunds on cancelled winter flights to American sun destinations in accordance with U.S. Department of Transportation rules.

Canada, unlike countries including France, Germany and the United States, has held off on sector-specific support for carriers. Instead Prime Minister Justin Trudeau has rolled out financial aid available across industries, including the wage subsidy and loans starting at $60 million for large firms.

“Nobody is helping this industry. As you know, we’re suffering like crazy,” said Eustache. “We’re not going to be on the same playing field as the others tomorrow.”

Transat lost $1.20 per share in the quarter compared with a loss of four cents per share a year earlier, while revenue totalled $9.5 million, down from $698.9 million.

On an adjusted basis, Transat said it lost $3.70 per share for the quarter compared with an adjusted profit of 16 cents per share in the same quarter last year.

The figure fell 70 per cent below analyst expectations of losses of $2.32 per share, according to financial markets data firm Refinitiv.

This report by The Canadian Press was first published Sept. 10, 2020.

You May Also Like

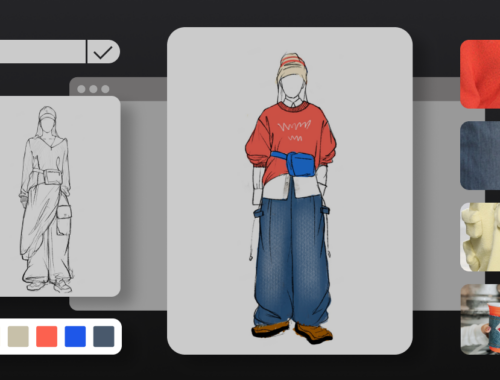

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

AI in Fashion: Revolutionizing Design, Shopping, and Sustainability for a Smarter Future

March 1, 2025