The 5 Best Travel Credit Cards

From bonus miles to free checked bags, we break down the best perks for packing plastic

At a recent happy hour, a friend boldly claimed that the Chase Sapphire Preferred card was the only travel credit card worth having. I argued that, living in the Northwest, Alaska Airline’s card was best. Another friend, an ardent Southwest Airlines disciple, began listing all the reasons that carrier’s credit card was second to none. This lively discussion clearly warranted a bit of research. Comparing cost, signing bonuses, and other perks, as well as the airlines themselves, here are the top picks.

Chase Sapphire Preferred

If you’re not loyal to a particular airline, this is your card. Use your points toward flights on any airline, with discounts if you book flights, cars, and hotels through the company’s travel portal.

Annual Cost: $0 for the first year, then $95

Sign-Up Bonus: 50,000 points after spending $4,000 in the first three months, plus 30,000 bonus points if you spend $30,000 in the first year.

Extra Perks

- 25 percent off airfare, hotels, car rentals, and cruises when you book through Chase’s rewards portal.

- One-to-one transfer of points to most leading frequent-travel programs.

- Double points per dollar spent on travel and at restaurants worldwide.

- No foreign transaction fees.

- No blackout dates.

Alaska Airlines Visa Signature

Alaska Airlines is a stellar carrier—on-time flights, great service, decent food, free beer and wine—and it just merged with Virgin America, so there are now 1,200 flights a day to more than 115 destinations across the United States, Canada, Mexico, and Costa Rica. The card has lots of perks, such as an annual companion fare and mileage bonuses that are easy to redeem.

Annual Cost: $75

Sign-Up Bonus: 30,000 bonus miles after you make $1,000 or more in purchases within the first three months, plus buy one ticket, get one free.

Extra Perks

- One companion fare every year that allows a friend to fly with you for only $99 plus tax.

- Free checked bag for you and up to six other passengers.

- Triple miles for every $1 spent directly on Alaska Airlines.

- No foreign transaction fees.

- No blackout dates.

- Rack up miles on travel partners including American Airlines, Japan Airlines, Emirates, Quantas, and more.

Southwest Rapid Rewards Premier Card

Like Alaska’s plastic, this a great card for the frequent domestic traveler, and if you’ve ever been at the tail end of the Southwest boarding process/cattle call, you understand the benefit of an early check-in. And, of course, there’s the biggest perk of flying Southwest: no change fees, a huge bonus when most airlines charge more than $150.

Annual Cost: $99

Sign-Up Bonus: 40,000 points when you spend at least $1,000 on purchases in the first three months.

Extra Perks

- Two points per dollar spent on Southwest flights.

- Two points per dollar on hotels and car rental partner purchases.

- 6,000-point anniversary bonus.

- Southwest Companion Pass: Earn 110,000 Southwest Rapid Rewards points within a single calendar year and you get to designate one person who can fly with you free of charge.

Gold Delta SkyMiles American Express

American Express is accepted at fewer places, but this card comes with some exclusive perks, including roadside assistance, car rental and travel accident insurance, and the Global Assist hotline, which provides 24/7 medical, legal, and financial services, plus select emergency coordination and assistance.

Annual Cost: $0 for the first year, then $95

Sign-Up Bonus: Earn 30,000 bonus miles after spending $1,000 in purchases in the first three months, plus a $50 statement credit after making a Delta purchase in the first three months.

Extra Perks

- Earn two miles for every dollar spent on eligible purchases made directly with Delta.

- Check your first bag free on Delta flights.

- Priority boarding.

- Discounted Delta Sky Club access.

- No foreign transaction fees.

Honorable Mention: United MileagePlus Explorer Card

Though this is a solid card with benefits comparable to the others on the list, United Airlines as a carrier brings the value down a notch, being ranked consistently lower than the other airlines featured here in customer satisfaction and quality. Consider this option if you live in or often travel through its hub cities of Houston, Denver, Newark, Chicago, San Francisco, Los Angeles, Washington, D.C., Tokyo, London, Frankfurt, or Guam.

Annual Cost: $0 for the first year, then $95

Sign-Up Bonus: 40,000 bonus miles after you spend $2,000 on purchases in the first three months.

Extra Perks

- Two miles per dollar spent on tickets purchased from United.

- No foreign transaction fees.

- Priority boarding.

- Two one-time United Club passes each year for your anniversary.

- Free first checked bag for yourself and a companion.

You May Also Like

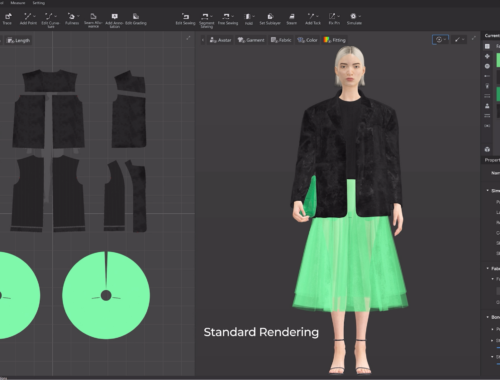

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Revolutionizing Fashion: How AI is Redefining Design and Sustainability

March 1, 2025