TD Insurance Acted In 'Bad Faith' Not Refunding Travel During Pandemic: Lawsuit

Canadians who’ve been forced to cancel trips during the pandemic have launched a class-action lawsuit alleging TD Insurance acted in bad faith when it didn’t offer them full refunds.

The lawsuit is seeking $10 million in damages from the subsidiary of Toronto-Dominion Bank, claiming it took an “adversarial and hostile approach” and treated the plaintiffs with “suspicion and contempt” when they tried to get reimbursed thousands of dollars through their travel insurance, according to the statement of claim launched by Samfiru Tumarkin LLP last week.

“TD Bank has been unjustly enriching itself by collecting premiums and refusing to pay legitimate claims,” the statement said. None of the allegations have been proven in court.

TD declined to comment on the case as it is before the courts, but said “our trip cancellation coverage is consistent with the industry-wide position,” said spokesperson Elizabeth Goldenshtein.

Watch: Should Canadian airlines give refunds amid the pandemic? Story continues below.

As COVID-19 cases spread at a disturbing pace across the world last spring, Canadians called off travel plans and airlines cancelled flights at an unprecedented rate. Unlike their European or American counterparts, Canadian airlines have resisted giving cash refunds, instead for the most part opting for vouchers, despite customer pushback.

Some Canadians turned to their travel insurance companies for reimbursement but faced barriers.

“Insurance is supposed to give you peace of mind. Courts have held that insurance contracts are to protect you, to help you during a difficult situation,” lawyer Sivan Tumarkin told HuffPost Canada on behalf of the class-action members.

“But now, companies are trying to weasel away from that responsibility en masse. Not just TD, others too.”

The lawsuit was spurred by lead plaintiff Kevin Lyons, who along with his wife and children, had planned months in advance to go on a Mediterranean cruise departing near Rome on March 8, 2020.

RELATED

-

Air Canada Sees 2nd-Most Airline Refund Complaints In The U.S. In May

-

Feds Keeping Tabs On 70 Cruise Ships With 4,000 Canadians On Board

-

Passengers Fined $1,000 For Refusing To Wear A Mask On WestJet Flights

But on March 2, Canada issued an advisory against all non-essential travel to northern Italy because of the rapidly spreading novel coronavirus. Lyon’s 16-year-old daughter is a Leukemia survivor and her doctor advised them not to go because of the health risk she’d face if she were to become infected with COVID-19, the lawsuit said.

Forced to cancel the trip, the Toronto family turned to their travel insurance with TD to be reimbursed for the non-refundable expenses totalling $6,673. Lyons also provided a letter from his daughter’s doctor, explaining why they had to cancel.

Initially, TD denied Lyons’ claim, incorrectly stating Global Affairs had not issued a travel advisory when Lyons had cancelled the trip, the lawsuit alleged.

“What did they expect these people to do? Go on the trip and get stranded?” Tumarkin said. “When the Lyons family was supposed to be on that trip there were cascading warnings.”

TD subsequently realized its mistake, but reimbursed only $79, claiming future credits would be available for the cruise and flights, the lawsuit said.

TD told HuffPost its trip cancellation coverage is available only if there are no other refund options.

“When a customer is provided with the option to receive 100 per cent credit and transfer their trip to a future date then they are not eligible for trip cancellation reimbursement in these instances,” the insurer said.

But in Lyons’ case, Expedia has yet to confirm any credits will be available for cancelled flights, and the cruise line’s credits are valid only to the end of 2021, said the lawsuit. Given Lysons’ daughter’s medical history, it’s unlikely the family would be comfortable travelling next year.

TD violated its own policy when it determined Lyons was not entitled to a full reimbursement because a credit or voucher may be an option, said the lawsuit. Its policy does not say the possibility of credit would disqualify a customer from getting their money back, Tumarkin said.

The class-action members have paid for insurance through premiums and credit card charges, and are entitled to have their claims reimbursed, said the lawsuit.

“It is only right that TD and other travel insurers honour their contractual obligations and pay legitimate claims when Canadians are experiencing unprecedented financial hardships,” Tumarkin said.

Click Here: camiseta rosario central

The lawsuit noted TD Bank reported insurance revenues in the second quarter of 2020 to be $1.13 billion, a 9 per cent increase compared to the same time the year before.

The class-action members are requesting TD be ordered to pay more than the claims to “deter insurers from making strategic, bad faith denials in the future,” the lawsuit said.

Since the lawsuit was filed a few days ago, Tumarkin said he’s received a huge amount of interest from people across the country, who’ve had experiences like Lyons with TD and other insurers. The lawsuit spans back to March 2018, but the pandemic has resulted in hundreds if not thousands of similar cases, he said.

Illinois New Members 2019

You May Also Like

Automatic Weather Station: Real-Time Environmental Monitoring and Data Collection

March 14, 2025

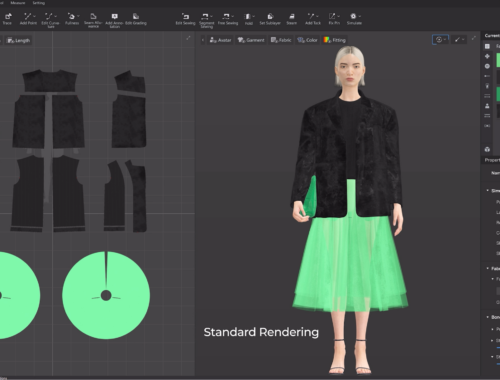

AI in Fashion: How Artificial Intelligence is Redefining Design, Production, and Shopping Experiences

February 28, 2025