Samsung shifting its focus in China to high-end and emerging sectors

Samsung Electronics Co Ltd is shifting its focus to high-end manufacturing and emerging sectors including batteries and capacitors in China, as the South Korean technology giant is reportedly planning to close its smartphone manufacturing plant in Huizhou, Guangdong province, in September-its last smartphone factory in China.

Industry experts said the tech heavyweight has faced intense competition from local smartphone makers, such as Huawei, Oppo and Vivo, and is adjusting its strategy in China, aspiring to seize the opportunities arising from electric vehicle batteries and automotive electronics devices.

Samsung did not respond to requests for comment on the Huizhou factory closure, but the official WeChat account of Huizhou Samsung Electronics last week posted recruitment information for other companies in Guangdong province, such as carmaker BYD Co Ltd and battery supplier Desay Corp.

The company closed its facility in Tianjin last December as part of ongoing efforts to enhance efficiency in production facilities. It also closed a plant in Shenzhen last April.

Meanwhile, Samsung said in December it planned to invest $2.4 billion to build new battery and capacitor plants in Tianjin.

Click Here: Arsenal FC Jerseys

Media reports in June said Samsung had already started offering voluntary redundancy to its employees in Huizhou. Samsung responded at the time that it was adjusting the production volume of its smartphone factory in Huizhou.

Aside from the plants in China, Samsung is also manufacturing electronic devices in Vietnam and India. It has increased its spending in Vietnam, establishing eight manufacturing plants with its total investment reaching $17.3 billion by last April.

Despite being the world’s biggest smartphone maker, Samsung’s sales are close to negligible in China. According to market consultancy Strategy Analytics, in the first quarter of this year, Samsung sales accounted for just 1 percent of the Chinese market.

“Samsung is adjusting its strategy in China due to its sluggish sales in the face of mounting competition from local rivals. Its poor business performance in the Chinese market-about 1 percent market share, couldn’t support the continuous expansion of production capacity,” said James Yan, research director at Counterpoint Technology Market Research.

Yan added that Samsung hopes to seize the opportunities in the emerging automotive industry, including electric vehicle battery and electronic components in the vehicle-mounted system.

Jia Mo, an analyst at market research company Canalys, noted the key reason why Samsung closed its factory in China lies in the rising costs in China’s manufacturing sector. “However, the move toward shifting its production capacity abroad means Samsung will gradually lose its share in the Chinese smartphone market.”

Statistics from market research firm International Data Corp showed that Huawei Technologies Co Ltd continued to lead China’s smartphone market last year, with a market share of 26.4 percent, followed by Oppo and Vivo. However, Samsung is losing most ground in mid-range and cheaper smartphones.

You May Also Like

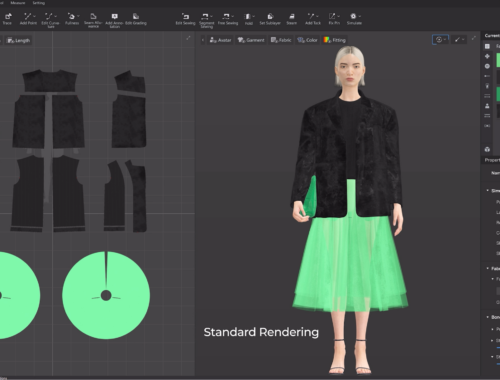

AI in Fashion: Redefining Design, Retail, and Sustainability for the Future

February 28, 2025

Dino Game: A Timeless Classic in the World of Online Gaming

March 22, 2025