Radical reforms to European lending

Radical reforms to European lending

A proposal to create a European rival to the World Bank is ambitious, but could cause problems for the Commission.

A group of experts advising national governments and the European Parliament has proposed the creation of a European Union development bank, which would lend to developing countries.

According to the expert group, which was chaired by Michel Camdessus, a former managing director of the International Monetary Fund and former governor of the Bank of France, the development bank should be created out of parts of the European Investment Bank (EIB), the European Bank for Reconstruction and Development (EBRD) and the European Commission.

The recommendations would, if implemented, amount to the creation of a European rival to the World Bank.

The expert group was created two years ago, at the request of MEPs and national governments, and asked to propose changes to be made in a mid-term review of the EIB’s current mandate for lending to countries and organisations outside the EU, which runs from 2007-13.

The EIB is a long-term lending bank owned by the member states, whose finance ministers are its governors. It lends to support the EU’s policy goals – notably for large infrastructure projects inside the EU, such as railways and motorways. Lending outside the EU accounts for only a tenth of its total activities, but that is still substantial money. The bank’s lending in Asia, Latin America, South Africa and in non-EU European countries totalled €37.3 billion in the period 2000-09. The bank is also involved in lending to African, Caribbean and Pacific (ACP) countries, notably through the ACP investment facility, which has a budget of €3.1bn for 2008-13.

Click Here: pinko shop cheap

Revamp of support

The Camdessus group concluded that the EIB’s lending outside the EU should be revised as part of a complete revamp of financial support to countries outside the EU.

The report says that reforms are needed to avoid duplications and competition between the “multitude of instruments and facilities” at the EU’s disposal, including those provided by the EIB. The group believes that institutional reforms are essential if the EU is to become a more coherent actor on the world stage.

In the short term, the group wants the creation of an “EU platform for external co-operation and development”, which would improve co-ordination between the EIB, the Commission, the EBRD and national development banks.

In the medium term, however, the group thinks that the EU should go further, either by shifting departments currently in the Commission and EIB that deal with non-EU lending into a new European Agency for External Financing, or (even more ambitiously) by creating a European Bank for Co-operation and Development (EBCD) that would also take on parts of the EBRD and national development banks.

One of the great advantages of a new agency or bank, the group says, is that it would combine the EIB’s financing of loans with the payment of grants, so creating sophisticated, ‘blended’ instruments tailored to recipient’s needs.

The Camdessus group observed that the EIB is “a powerful instrument to serve the EU’s external policies and related objectives, which has served the EU well so far”. But it says that “the capability of the EIB to properly contribute to EU external policies and serve EU interests is hampered by limited staff and limited local presence”. It wants the EIB to have more staff and take on more risk. Whereas currently the EIB’s mandate varies from continent to continent, the group recommends that the EIB should have common, high-level objectives across the globe. The mandates are agreed by the EU’s finance ministers and the European Parliament.

The Commission will now have to decide how much of the group’s report it wants to include in its own proposal for changes to the EIB’s mandate, which it will submit for approval to the Parliament and Council of Ministers before the end of April. Endorsing the Camdessus group’s more radical proposals would be difficult for the Commission, as, despite the potential benefits, it could mean ceding control over some its own financing activities.

Philippe Maystadt, the president of the EIB, said that the EIB welcomed many of the report’s ideas, including the creation of the co-operation platform. He was more guarded about the possible creation of an agency or a European development bank.

“Certainly, I share the concern which lies at the basis of these suggestions,” Maystadt said. “It’s true that we are losing in terms of efficiency and visibility because of the lack of co-ordination.” He said that placing the EIB, the Commission and other players within the same structure was “rather radical”. “It’s a possible option, but there are also other possible options,” he said.

Unique skills

The EBRD’s reaction to the report was that while improvements in co-operation “are only to be welcomed”, any reforms would need to take into account the need to preserve the bank’s “unique” skills and expertise.

Olli Rehn, the European commissioner for economic and monetary affairs, said he would study the group’s proposals, which would “nourish debate”.

The Camdessus group has posed a dilemma for the Commission, which prides itself on its development policy expertise and would be reluctant to see its powers diminished. It is only likely to support the creation of a new agency or bank if it is allowed to play the leading role, something that member states (the shareholders of the EIB and EBRD) are unlikely to accept.

Despite the compelling arguments in favour of better co-ordination, the Camdessus group will find that its most ambitious proposals are a hard sell.

Galileo contracts awarded

You May Also Like

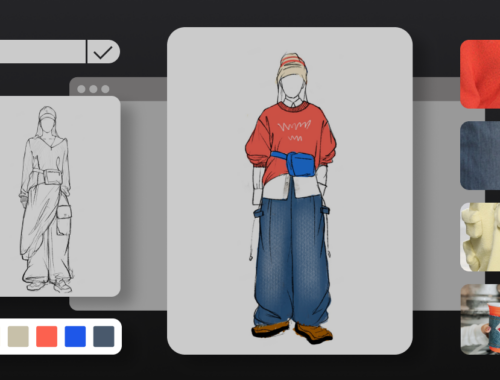

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

AI in Fashion: Revolutionizing Design, Shopping, and Sustainability

February 28, 2025