MEPs want to give more power to securities and markets authority

MEPs want to give more power to securities and markets authority

Parliament committee discusses legislation aimed at reforming regulation of credit-rating agencies.

Members of the European Parliament believe that the European Securities and Markets Authority (ESMA) should have the power to fine credit-rating agencies itself rather than relying on the European Commission to do so.

On Monday (22 November) the Parliament’s economics and monetary affairs committee discussed legislation aimed at reforming the way credit-rating agencies are regulated.

They called for greater competition between credit- rating agencies.

The position adopted by the committee acted as a prelude to discussions that started yesterday (24 November) between MEPs and the Council of Ministers on the Commission’s proposals for the amending regulation, which would give ESMA a central role in the supervision to be carried out on credit rating agencies.

Supervision and fines

Members of the committee argued that ESMA’s power of directly supervising credit-rating agencies should be matched by giving it the right to levy fines on agencies that breach operating and reporting rules. The Commission argues that it is best placed to do this.

The position adopted by the committee recommends that ESMA carry out random checks of the ratings issued and, if it considers necessary, should be able to ask for explanations, look deeper into that agency’s ratings, and investigate the agency thoroughly. It would also give ESMA powers to make dawn raids on the offices of agencies.

You May Also Like

What is an Automatic Weather Station?

March 15, 2025

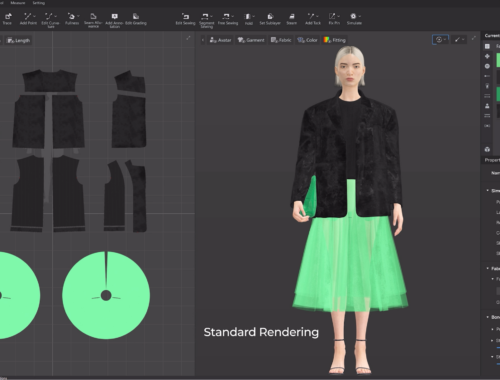

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025