Here’s How Bad Credit Can Affect Your Mortgage

You probably already know that your credit score is an important part of your financial health. But did you know that it’s one of the most important factors in qualifying for the best mortgage rates on the market?

So, how does your credit score affect the mortgage rate you can get? Can you still buy a home with poor credit? Here’s everything you need to know.

What is a credit score?

Your credit score is a number, generally between 300 and 900, that indicates how likely you are to make repayments on your loans (in other words, your overall credit-worthiness). A higher score shows that you have been diligent about making repayments in the past and are therefore less likely to default. This makes companies more inclined to lend to you.

So what counts as a “good” credit score? A score above 680 is considered good, 600 to 679 is fair, while a score under 599 is often considered poor.

TransUnion and Equifax are the two companies that track credit scores in Canada. Every time you borrow or make a repayment on a credit card, car loan, mortgage, or any other type of credit account, these companies add these activities to your credit history. Your credit score is then derived from your credit history.

READ MORE

-

Should You Use A Broker Or A Bank When Getting A Mortgage Loan?

-

A Mortgage Pre-Approval Could Save You Stress When You’re Buying A Home

-

Fixed Or Variable? How To Decide Which Mortgage Is Right For You

Here’s a breakdown of how credit scores are generally calculated:

- Payment history (35%): How often you make your payments on time. Any bankruptcies and delinquencies will have a negative impact on your payment history.

- Amounts owed (30%): The outstanding balances you have on any of your accounts as well as how much of your available credit you actually use. A good rule of thumb is to use only 30% of your available credit.

- Credit history (15%): How long you’ve maintained your credit accounts and how often you use them.

- Credit mix (10%): Types of credit accounts you currently maintain and how many you have of each.

- New credit (10%): How many credit accounts you’ve opened recently. Too many applications for new credit accounts can lower your score.

Several companies offer free credit score checks, which can help you understand your current financial standing and how you can improve your credit score. Just remember that these services won’t always give you the same number that your mortgage provider uses, as there are many different methods for calculating your score.

Click Here: Fjallraven Kanken Art Spring Landscape Backpacks

How your credit score impacts your mortgage rate

To understand how bad credit affects mortgage rates, it helps to think like a mortgage lender. Lending to someone with poor credit is risky, as they’re more likely to not make their payments on time or default completely. To compensate for the extra risk, lenders agree to issue mortgages with higher rates to people with lower credit scores.

If your credit score is below 600, most of the major banks in Canada will not approve you for a mortgage. Instead, you may have to use a “B lender” or even a private lender. Lenders such as these have mortgage products specifically for people with low credit scores.

Watch: These are the best credit cards to have during a financial pinch. Story continues below.

Here’s how your mortgage rates might look in three different credit score ranges:

680 or higher: With good to excellent credit, you should be able to qualify for some of the best mortgage rates available with all of the major mortgage lenders. While other eligibility criteria such as employment status, down payment size, and home purchase price could limit your options, your credit score will not do so. Note that some of the lowest mortgage rates available are promotional rates, which oftentimes come with a minimum credit score criteria of 680 or higher.

600 to 679: With fair credit, you should be able to get a mortgage from many providers, though some lenders with strict requirements may still reject your application. Others might lend to you but may offer you a higher mortgage rate than one that you could get with a better credit score. If your score is at the lower end of the range, lenders will evaluate why your score is low and take that into consideration when they make their decision.

Below 599: With a poor credit score, you might find it hard to get a mortgage from a top-tier lender. If that’s the case, you could be forced to borrow from a “B lender” that specializes in mortgages for people with poor credit. These “subprime” mortgages come with much higher rates than those available from the major banks and financial institutions.

A higher mortgage rate can make a big difference in the amount of interest you pay. Let’s take a $500,000 mortgage with a 25-year amortization period as an example. With a rate of 1.99%, you’d pay $45,654 in interest over a 5-year term. With a mortgage rate of 3.99%, you’d pay $92,837 in interest over the same 5-year term — more than twice as much! Use a mortgage payment calculator to run your own numbers.

Tips for getting a mortgage with bad credit

If you have bad credit but want to get a mortgage, don’t despair completely. While a low credit score makes it harder to get a great rate, there are straightforward steps you can take to get yourself on track towards owning a home.

Improve your credit score: If you can afford to wait a little longer before buying a home, you can work to improve your credit score before you apply for a mortgage. Making repayments on time, keeping credit cards and accounts in good standing, and limiting usage of your available credit limit can all help increase your score.

Consider a co-signer or joint mortgage: If your credit isn’t high enough to secure a great mortgage rate, adding another applicant with a good credit score may help. Joint and co-signed mortgages are approved based on the financial situation of both applicants, which could score you a better mortgage rate than you could get on your own.

Save for a larger down payment: A big down payment can signal that you are financially stable. Remember that your credit score is not the only criteria that lenders use to evaluate your application. If you have stable employment, a high income, low overall debt levels, and a large down payment, lenders may look at your application favourably. A large down payment also helps offset the cost of a higher mortgage rate. The larger your down payment, the less you’ll need to borrow, resulting in significant savings. Furthermore, a larger down payment will also increase how much house you can afford — use a mortgage affordability calculator to better understand this.

Work towards your next renewal: Getting a less-than-ideal mortgage today doesn’t stop you from getting a better one in the future. You’ll have a chance to requalify for a new mortgage with a different lender when you renew. If your credit score has improved by your renewal date, you may be able to qualify for a better rate then.

The bottom line

Having a good credit score is critical when you’re looking to borrow money. Because a mortgage is the biggest loan you’re ever likely to take out, it’s essential to consider the effect that your credit score can have on your mortgage application.

If you’re able to take the time to increase your credit score to 680 or higher before you apply for a mortgage, you’ll give yourself more options, and a better chance of getting a great mortgage rate.

You May Also Like

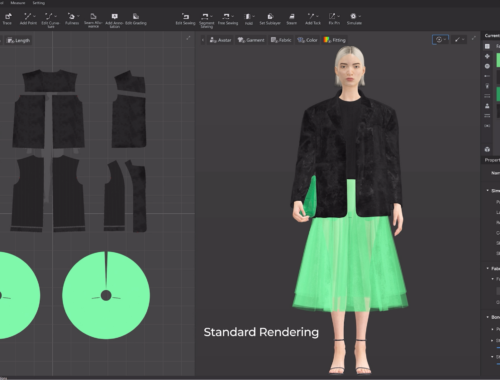

AI in Fashion: Transforming Design, Shopping, and Sustainability for the Future

March 1, 2025

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025