Growing Your Small Business In A Flash

Entrepreneurs know perhaps better than anyone that time is money and money is time. You work hard growing your business, which is why finding ways to operate more efficiently and intelligently is key.

But you know who else likes to be efficient? Your customers. Advanced commerce technologies such as online shopping and contactless payments at major retailers have raised consumers’ level of expectation that their shopping can take place anytime, anywhere and with as little friction as possible. Some studies have suggested that humans spend roughly six months of their lives lining up for things. How many times have you seen customers bail out of a long checkout line? A recent survey revealed that 75 per cent of customers asked said they’d done just that. In collaboration with Interac, here’s how Interac Flash can improve your company’s growth.

According to a study conducted by Interac, nearly 70 per cent of customers said that they rarely carry cash anymore, while 65 per cent said that they expect stores to offer contactless payment options, such as tapping a card or device, making it more important than ever for small businesses to adapt to the changing habits of their customers.

Small business owners agree. Miranda Voth, a Toronto-based medical aesthetician and lash technician, implemented a Interac Flash to her business years ago and hasn’t looked back. “My clients would always tell me about their adventures to get cash before their appointments – stopping at the corner store to buy something and get cash back to pay, that kind of stuff!” Voth says. “I wanted to make it as easy as possible for my clients to pay for their lash appointments, so I looked into accepting Interac Debit.”

Having a contactless payment option isn’t just for major retailers anymore, and implementing it is easy. Offering the option to your customers will reduce checkout line sizes and walk-outs and allow businesses to serve more customers. In fact, in 2018 Canadians made more than $45 billion in transactions with Interac Flash.

“I think Canadians use Interac Flash more than cash because no one carries cash anymore,” Voth says. “It’s faster because no one has to do the math to give back change.”

And if you’re worried about whether or not it’s secure, don’t be. All your customers have to do is tap their card or smart device to your contactless terminal and they’re done. There is actually an additional layer of security because there’s no risk of customer PINs being exposed or no customer information transferred, and when paying with a device there’s often additional security features like fingerprint or facial recognition authentication. Add to that the safeguards of transaction amount limits and total daily spending limits when tapping the card (if either is breached, the cardholder then needs to insert their card and enter their PIN), the system offers convenience and peace of mind.

For merchants, the added benefits are also substantial. Not only does it reduce the need for you to handle, count and physically deposit cash at the bank, but in the event that someone uses a card fraudulently in your store, there are no chargebacks to merchants. And for restaurant owners concerned about contactless payments affecting customer tip rates, the implementation of a tip-enabled terminal will still prompt the customer to add a tip.

Whether you’re running a must-try food truck or a luxe beauty boutique, the benefits of being smart, secure and efficient at checkout are substantial. And expected. Seventy per cent of customers surveyed say that they think contactless payments make their shopping experience better. And with a resounding endorsement like this, why not turn yours and your customer’s time into money?

The path forward is exciting. To learn more about implementing Interac Flash, visit their website.

You May Also Like

シャーシ設計の最適化手法とその応用

March 20, 2025

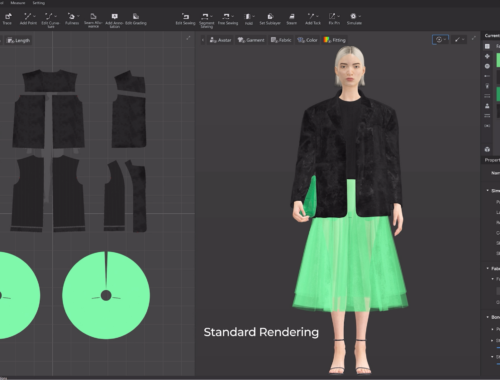

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025