French Oil Company Writes Off $9.3 Billion In Alberta Oilsands Assets

CALGARY — French energy giant Total says it is writing off $9.3-billion (US$7 billion) worth of oilsands assets in Alberta and cancelling its membership in the Calgary-based Canadian Association of Petroleum Producers (CAPP).

Total now considers oil reserves with high production costs that are to be produced more than 20 years in the future to be “stranded” given its carbon reduction targets and because the resource may not be produced by 2050, the Paris-based company said Wednesday.

It will take writedowns worth $7.3 billion related to its 24.6 per cent ownership in the Fort Hills oilsands mine operated by partner Suncor Energy Inc., the company said, and its 50 per cent stake in the Surmont thermal oilsands project operated by partner ConocoPhillips.

Total will also write off $2 billion in other oilsands assets, it said, along with $1.07 billion on its liquefied natural gas assets in Australia.

Watch: What does $0 oil mean for Canada? Story continues below.

Total said it is leaving CAPP because of a “misalignment” between the organization’s public positions and those expressed in Total’s climate ambition statement announced in May.

“It is disappointing that they would write down Canadian assets, and increase their focus in Africa and Brazil and the Middle East,” said CAPP CEO Tim McMillan in an interview.

“As a company, over the last few years, they’ve increased investment and focus in those jurisdictions.”

He added it’s disappointing Total is bowing out of CAPP but said, “that’s their prerogative.”

Alberta Energy Minister Sonya Savage called Total’s decision “highly-hypocritical.”

She said Canada — with the third largest oil reserves in the world — is perfectly positioned to continue to offer investment in a stable and ethical democracy.

“At the same time Total is dismissing the leadership of Canadian producers who are doing their part with active strategies that have reduced emissions, they continue to invest in countries such as Myanmar, Nigeria and Russia,” she said in a statement.

“This highly-hypocritical decision comes at a time where international energy companies should, in fact, be increasing their investment in Alberta, rather than arbitrarily abandoning a source of a stable, reliable, supply of energy.

In May, Suncor registered an impairment charge of $1.38 billion on its 54.1 per cent share of Fort Hills in view of lower oil price prospects.

The other partner in Fort Hills, Vancouver miner Teck Resources Ltd., took a $474-million writedown in May on its 21.3 per cent stake and has also cancelled its CAPP membership, saying it was part of a cost-cutting program.

“Total’s decision to write down their tar sands assets and quit Canada’s biggest oil lobby group for its opposition to action on climate change underscores the urgency of ensuring that COVID-19 stimulus plans grow a green economy and transition workers securely into it,″ said Greenpeace Canada campaigner Keith Stewart on Wednesday.

“As the world transitions away from fossil fuels, starting with the most polluting sources, the tar sands are hemorrhaging investors.”

Total has been distancing itself from the oilsands for several years, although a Canadian Press analysis last year revealed it actually produced more from the oilsands in 2018 than any other foreign company.

When it sold its undeveloped Joslyn oilsands mining project to Canadian Natural Resources Ltd. in 2018, it said it was part of a strategy to move away from high cost oilsands investments.

The same rationale was used in reducing its stake in Fort Hills in 2017.

European banks shying away

Earlier this week, Frankfurt-based Deutsche Bank said it would join a list of European lenders and insurance companies that say they won’t back new oilsands projects.

The German bank said its new fossil fuels policy will also prohibit investing in projects that use hydraulic fracturing or fracking in countries with scarce water supplies, and all new oil and gas projects in the Arctic region.

Two years ago, Europe’s largest bank, HSBC Holdings plc, announced it would no longer offer financial services for new oilsands projects or pipelines, a move that led to Suncor vowing to end all business with HSBC, including in its conventional oil operations in Europe.

This report by The Canadian Press was first published July 29, 2020.

Click Here: Bape Kid 1st Camo Ape Head rompers

You May Also Like

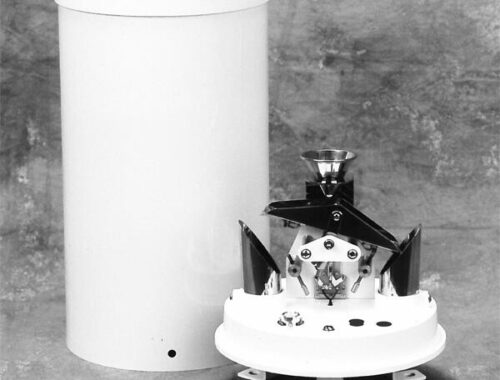

10 Practical Applications of Rain Gauges in Everyday Life

March 20, 2025

China’s Leading Pool Supplies Manufacturer & Supplier

March 25, 2025