Eurozone holds crisis meeting

Eurozone holds crisis meeting

Leaders seek to reassure rattled markets and to agree to reform of the eurozone’s rules.

Leaders from the 16 eurozone countries are expected to sign up tonight to far-reaching reforms to strengthen economic governance in the single currency area in an effort to convince financial markets that the current debt crisis can be overcome.

They will also formally activate an €110 billion emergency loan facility for Greece.

Leaders meeting in Brussels this evening will call for the creation of a permanent ‘crisis resolution’ mechanism to provide financial aid to member states that get into difficulties and to speed up plans for tighter regulation of the financial sector. Diplomats said that the statement would specifically call for sanctions to be imposed on member states that repeatedly break EU rules on debts and deficits. Governments will call for strict adherence to the rules of the EU’s stability and growth pact, which require member states to keep their deficits within 3% of gross domestic product (GDP).

Herman Van Rompuy, the president of the European Council, called the eurozone summit on 2 May as a response to the turmoil on financial markets triggered by concerns about that the debts of other eurozone countries, and in the days the markets’ mood has darkened. The euro has this week lost 4% of its value against the dollar and the Stoxx Europe 600 index lost 3.9% of its value this week – the worst weekly loss since November 2008.

Speaking before the start of the summit this evening, eurozone leaders were keen to convey a sense of urgency. George Papandreou, Greece’s prime minister, said on arriving: “We will reaffirm our confidence in our economies and in our common currency.” He added: “I believe this is a very important message for our economic recovery.”

Germany’s Chancellor Angela Merkel noted that “it is not only Greece that must consolidate its budget. We must all work so the stability and growth pact can be applied as soon as possible.”

Olli Rehn, the European commissioner for economic and monetary affairs, is planning to present proposals on reinforced economic governance next Wednesday (12 May). He will tailor the ambition of his proposals to the political appetite for new measures expressed by leaders tonight. Rehn has said that the eurozone needs “sharper teeth” to enforce budgetary discipline.

Financial markets

The leaders will also discuss regulation of financial markets.

Merkel stated on arriving in Brussels that “we must speed up regulation of financial markets. We have no time left. It must go more quickly.”

The leaders’ statement is expected to specifically call for tighter regulation of credit rating agencies. Standard & Poor’s, one of the big three rating agencies, has been heavily criticised for decisions last week to downgrade debt issued by Greece, Spain and Portugal.

Yesterday, Merkel, and Nicolas Sarkozy, France’s president, wrote in a letter yesterday to Herman Van Rompuy, the president of the European Council, and José Manuel Barroso, the president of the European Commission, asking the EU to review the role ratings agencies play in “amplifying crises”, and their effect on “financial stability”. They want greater competition on the ratings market and financial regulations to be less reliant on credit ratings. Ratings are, for example, currently used to determine the capital that banks must hold, and where pension funds can invest.

Loan to Greece

Eurozone leaders will also confirm a €110bn loan facility for Greece agreed on 2 May by eurozone finance ministers and the International Monetary Fund, after it became clear that market fears that Greece would default had made it impossible for the Greek government to refinance its debt. The eurozone will provide €80bn to Greece, and the IMF €30bn for 2010-12.

Germany and France, the two largest eurozone lenders under the facility, today completed their parliamentary procedures to authorise the loans. The facility will save Greece having to seek any market financing for the next two years, with the expectation that it will slowly return to the markets thereafter. Greece’s debt refinancing needs over the next three years are estimated at €150bn.

Greece’s Prime Minister Papandreou said that Greece had done its “part” to repair its public finances by yesterday adopting a €30bn package of austerity measures, including an increase in value-added tax, increases in excise taxes on petrol, tobacco and alcohol, and a radical pensions reform. “We are determined to move forward,” he said.

The country other than Greece currently most affected by the debt crisis is Portugal. Following a sell-off of Portuguese government debt this week, the country’s parliament today increased taxes on incomes and capital gains in an effort to convince markets that the country can reduce its deficit. Portugal’s debt agency offered to buy back €4.6bn of maturing bonds a week early. The bonds mature on 20 May, but the agency offered to buy them back on 12 May to prove the country does not have a liquidity problem.

You May Also Like

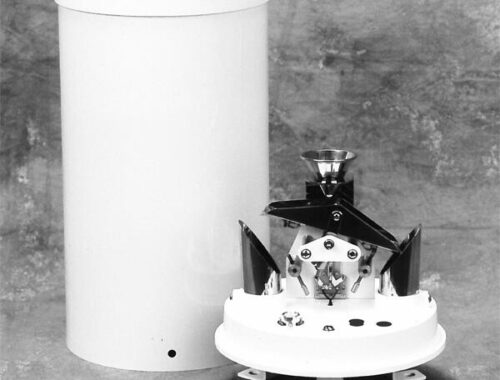

10 Practical Applications of Rain Gauges in Everyday Life

March 20, 2025

AWS Weather Station: Monitoring Environmental Conditions with Precision

March 17, 2025