EU ready to spend €500bn to contain crisis

EU ready to spend €500bn to contain crisis

IMF and the ECB join the EU in its effort to shore up the euro and protect the eurozone’s weakest economies.

The European Union’s finance ministers agreed early this morning to make available loans of up to €500 billion to counter any possibility of default on government debt in the eurozone.

The International Monetary Fund would, according to the agreement, provide further funding of half the eurozone’s contribution. So a total of €750bn has been put together as a war-chest to help the eurozone ward off the doubts of the financial markets both about government debt and the euro itself.

Spain and Portugal, the two countries whose government debt has, after Greece’s, been subject to attack on the financial markets, promised the meeting that they would accelerate proposals to improve their public finances. Those proposals will be presented to a meeting of the EU’s finance ministers on 18 May. José Luis Rodríguez Zapatero, Spain’s prime minister, will announce his further steps on Wednesday (12 May).

The finance ministers’ meeting broke up at 2am Brussels time, having started at 3pm.

Olli Rehn, the European commissioner for economic and monetary affairs, said the steps taken showed that the eurozone would defend the euro “whatever it takes”.

The European Central Bank also announced in the early hours of morning that it would intervene on the secondary market of both public and private debt securities, describing its move as an attempt “to ensure depth and liquidity in those market segments which are dysfunctional”.

It will intervene first using a six-month refinancing operation on 12 May, and then through three-month operations over the course of five weeks, from 26 May to 30 June.

Jean-Claude Trichet, the president of the ECB had spent Sunday in Basel at a meeting of central bankers from across the globe. The central bankers announced that because of liquidity problems in US dollar short-term funding, they would be re-establishing temporarily swap facilities for US dollar liquidity.

Lucas Papademos, the ECB’s vice-president, attended the meeting in Brussels of EU finance ministers. Rehn afterwards described the ECB measures as “very significant”, but refused to comment further, saying that he wanted to respect the independence of the bank.

The defensive measures agreed by the finance ministers are in two parts, which together make up what the EU’s leaders refer to as a ‘European stabilisation mechanism’.

The first part, which would be more speedily mobilised, is a facility of up to €60bn that can be made available based on article 122 of the EU’s Lisbon treaty, which allows for financial support to member states in difficulties caused by “exceptional circumstances” beyond member states’ control. The meeting has decided that such exceptional circumstances exist and the €60bn facility is opened. It is similar to, but separate from, the facility created last year for balance of payments help to member states outside the eurozone, which has already been used to help Romania, Hungary and Latvia.

The International Monetary Fund would complement the €60bn with up to €30bn. Since the fund is a community instrument administered by the European Commission, the money could be made available in a matter of days, if needed.

The second, more substantial part of the stabilisation mechanism is based on an intergovernmental agreement between the countries of the eurozone, that they will, if needed, provide a further €440bn, “guaranteed in a co-ordinated manner…respecting their national constitutional requirements”. Again, the IMF will provide “at least half as much”.

Rehn said that this second fund, could, if necessary be activated in a matter of weeks – he made a comparison with the loan to Greece, which was signed off on Sunday, less than a month after the Commission and IMF received a negotiating mandate on 11 April. He said the interest rate on loans would be of a similar order as that for Greece.

As was the case with that loan, loans from this fund would require the unanimous support of members of the eurozone and would come with similarly strict conditions attached.

On Wednesday, the Commission will be setting out proposals for improving fiscal sustainability in the eurozone. But before that, the markets will have delivered an initial verdict on whether the finance ministers’ agreement is convincing.

You May Also Like

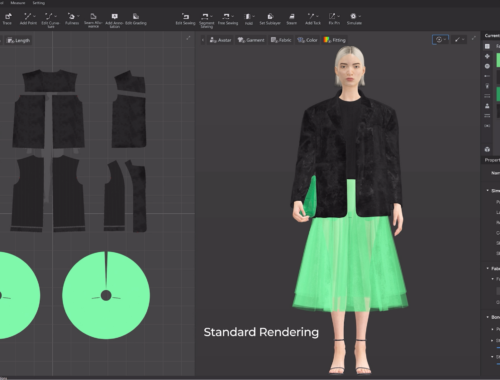

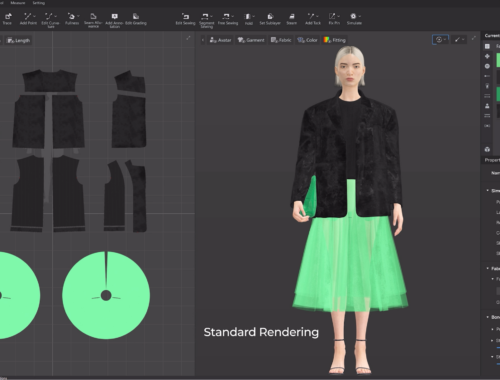

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Generated Blog Post Title

March 1, 2025