Commission warns of economic imbalances

Commission warns of economic imbalances

Report identifies 12 member states that need to take corrective action.

The European Commission has named 12 countries with significant economic imbalances that require correction or further in-depth investigation.

Indicators such as housing-price bubbles, high labour costs and large private-sector debt have been used for the first time to single out the EU member states that show most cause for concern. Some of the EU’s largest economies, including France, Spain, Italy and the UK, are among the group of 12 – but, notably, not Germany.

Olli Rehn, the European commissioner for economic and monetary affairs, said that it was not a case of “naming and shaming” the countries, but was “an objective way of identifying harmful imbalances” and was a “pre-emptive tool”.

The results presented today are based on a “scoreboard” of ten indicators, and are part of the Commission’s alert mechanism report to prevent economic imbalances under the EU’s new, tougher economic governance rules.

The findings could be used to pave the way for sanctions against countries, but today’s report is merely the first step. The Commission will carry out further in-depth investigations into the reasons for the imbalances and could then make a formal recommendation to a member state that it takes corrective action. Only when it has been found not to do so can it be fined.

Rehn said that today’s results would “deepen the dialogue with member states” – but he said the problems could not be “over-generalised”. He said, for example, that the trends in certain member states – notably Sweden and Denmark – pointed towards a property-price bubble, but that this was not the case across the board.

In Spain, problems caused by a collapsing property market raised concerns, as did its high employment rate. In Italy, very high public debt and low growth potential was identified as a problem.

Belgium, France and the UK were singled out for further examination because of losses seen in their export market share, while in Bulgaria, labour costs were identified as a cause of concern. Hungary was singled out for its net international investment position.

High corporate debt was a problem in Cyprus and Slovenia while Finland had a problem with a loss of export share and experienced the same property bubble difficulties as Denmark and Sweden.

Germany was not identified as having worrying imbalances despite criticism that its relatively good economic performance is harming other member states.

Rehn said that “further analysis of divergences across member states” would be carried out in the coming months. Countries subject to bail-outs or other financial assistance programmes – Greece, Ireland, Portugal, Romania and Latvia – were not included in the report.

You May Also Like

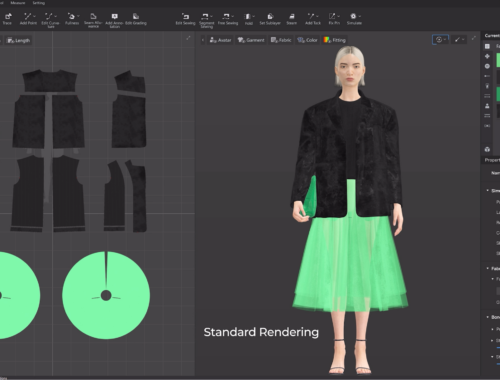

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Automatic Weather Station: Real-Time Environmental Monitoring and Data Collection

March 14, 2025