Christmas Spending Could Drop This Year As Canadians Grapple With Debt

Christmas is less than 50 days away and that means ’tis the season for holiday shopping.

For many Canadians, the holidays are shaping up to be a little different this year. A new survey released this week by Equifax Canada found 55 per cent of Canadians are planning to spend less on gifts as consumers finally feel the pinch of their finances.

“I suspect any retailers reading this type of survey data are probably cringing a bit,” Julie Kuzmic, director of consumer advocacy at Equifax Canada, told HuffPost Canada.

“It does indicate that people are paying more attention, or paying attention, to their current financial situation and then what actually makes sense in terms of holiday spending.”

The reality is many Canadian households are drowning in debt. Debt-to-income ratios have risen over the past decade in Canada, even as they’ve declined in the U.S. Canadian households owed nearly $1.79 in debt for every dollar of disposable income at the end of last year, according to Statistics Canada.

Watch: Canadian retailers got off to a rough start this year. Story continues below.

Debt isn’t always a bad thing, and sometimes it’s essential, especially for those buying a home. But it’s a risky proposition if there’s no plan to pay it off.

“It doesn’t really serve anybody to have people running up unmanageable levels of debt and for us to end up in an economic situation where a downward spiral starts as a result,” Kuzmic said. “If there’s a silver lining here, it’s the fact that most Canadians remain conscious of their debt obligations and want to avoid adding too much debt heading into the new year.”

A separate survey published Wednesday by Rates.ca found nearly half of Canadians overspent on holiday purchases last year, 40 per cent have no plan to pay their bills and almost a quarter of respondents said they’d dip into their savings to cover expenses.

Shannon Lee Simmons, a certified financial planner and the author of two books about managing money, told HuffPost Canada these bills add up.

“Canadians are carrying more consumer debt than ever and I think people want to get a grip on that and not go further into debt or eat into savings,” she said.

According to the Equifax survey, Canadians between the ages of 35 and 44 expressed the most concern about current debt levels, and women were more likely than men to say they’d be cutting back on spending this year.

But that’s always easier said than done. After all, no one wants to look cheap around family and friends while opening presents on Christmas morning.

“The holidays are emotionally charged. There’s a lot of pressure to spend,” Simmons said. “I think people often budget for gifts but not the additional cost of merrymaking like hosting and travel. It all adds up. These forgotten costs can leave people frustrated and with a credit card hangover.”

And just like an alcohol hangover, a financial one can be painful, too.

The Canadian Press reported on a survey earlier this year that found 46 per cent of Canadians are $200 or less away from financial insolvency at the end of the month. The same poll suggested nearly one in three Canadians don’t make enough money to cover their bills and debt payments.

In 2017, Canadians spent an average of $705 on holiday shopping, according to a Retail Council of Canada survey conducted by Leger.

Paying off debt might seem like too much to handle, but Simmons said it’s better to start slow than do nothing.

“At some point you have to tackle it. The first thing to do it ensure you’re at least making your minimum payments so that your credit score doesn’t take a huge hit. Secondly, make a realistic plan to pay it back.”

The holidays can be a good time for self-reflection when it comes to finances, especially since it’s financial literacy month in Canada.

Kuzmic said she sees more of a focus now on “conscious consumerism” where people are more aware of the financial and environmental impact of gift-giving.

Click Here: COLLINGWOOD MAGPIES 2019

READ MORE

-

3 In 10 Canadians ― Including High Earners ― Can’t Cover Expenses

-

Canada’s Solid Retirement Plan May Be Why We’re So In Debt

-

Canadians Are Stressing Over Money And It's Costing Businesses Billions

Financial experts recommend making a plan, sticking with it and not letting your emotions get in the way. If you need to make a budget or warn family and friends about your intentions, it’s better to do that than overspend.

“It’s OK to buy things, but let’s be a little more conscious about what we actually need and how much we actually need,” Kuzmic said. “Maybe you don’t need to buy that many gifts for every person on your list.”

“Give the gift of time to people you love,” Simmons said. “The holidays don’t have to be about stuff. It can be about experiences with people you love!”

You May Also Like

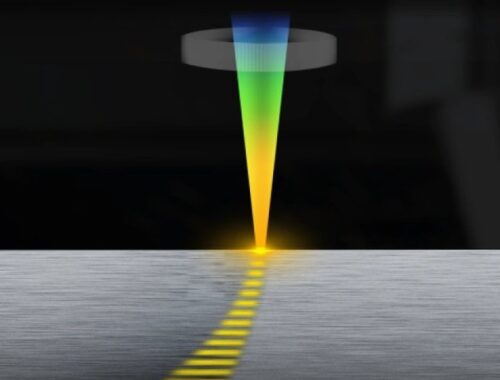

HOW TO IMPROVE PRODUCTION EFFICIENCY OF A LASER PLATE CUTTING MACHINE

November 22, 2024

AI in Fashion: Redefining Design, Personalization, and Sustainability for the Future

March 1, 2025