CERB Recipients Face A ‘Shock’ At Tax Time. Here’s How To Prepare

Click:buy Chlorine tablet

If you’re one of the millions of Canadians who have received payments from the Canada Emergency Response Benefit (CERB) in recent months, get ready for an unpleasant reality next spring: There’s a good chance you will owe money to the Canada Revenue Agency.

Payments from CERB are fully taxable, and ― unlike with a typical paycheque from an employer ― the taxes owed aren’t taken off the amount the government sends you.

For many CERB recipients, “it will be a shock when they find out what they owe next year,” debt relief expert Doug Hoyes of Hoyes, Michalos & Associates told HuffPost Canada in an email.

“Even worse, many people get a tax refund, so if you normally count on a $1,000 refund, next year not only will you not get the refund but you may end up owing $1,400, or whatever.”

Watch: Tips for growing savings on a low income. Story continues below.

For recently unemployed people, a tax hit could be particularly hard to bear, and with millions of Canadians having received CERB this year, that could prove quite a hit to Canadian consumers as a whole.

For that reason, it’s possible ― some say likely ― the government will tweak the program somehow to ease that tax burden.

But for now, no such tweaks have arrived, and the recent crackdown on CERB fraud would suggest the government is serious about squaring CERB recipients’ taxes.

How big a hit am I facing?

It depends entirely on how much money you make in 2020.

If you make very little before and after CERB, you may not have to pay anything. The basic personal exemption for federal taxes for 2020 is $13,229, so if you make less than that this year, you won’t owe federal income taxes.

If your only income in 2020 is CERB, and you got the full $12,000, you will owe nothing in Alberta, Quebec and Saskatchewan, but elsewhere you will owe provincial taxes of between $46 (Nova Scotia) and $234 (Manitoba).

Once you get past those personal exemption amounts, the amount owing rises into the thousands quickly. Everyone’s situation is different, so you will have to assess your own.

Get an idea of what you will have earned

To figure out what the tax hit will be on your CERB payments, you’ll need three numbers:

- What you made this year before CERB

- how much you got and/or will get from CERB

- what you think you will make this year after CERB

For many, that last number may be little more than a guess, but even a guess is better than nothing.

Once you have these numbers, you can figure out how much you are likely to owe in taxes.

Joe Devaney, a chartered accountant, financial advisor and board member of VideoTax.ca, suggests using the basic tax calculator at TaxTips.ca.

“Enter in all of your expected non-CERB income for 2020. Note the resulting taxes payable. Run it again including your CERB payments. The difference is what you should expect to pay, and budget accordingly,” Devaney wrote in an email to HuffPost Canada.

But what does “budget accordingly” mean?

One strategy is to open a separate savings account from the one you use on a daily basis, and deposit a chunk of any income into that account, said Jordan Damiani, a senior wealth advisor at Meridian Credit Union.

“If you need the CERB money right now, you might not be able to put anything away today. If you can, that’s helpful, but if you can’t, you can make up for that when you go back to work,” he said.

“It’s important to make sure you don’t just go from one financial hardship to another.”

If you’re working after CERB, you can actually ask your employer to take a bit more off in taxes from your paycheque, which will reduce (or even eliminate) what you owe on CERB at tax time, Damiani suggested.

For some people, it might make sense to put those savings into an RRSP because that amount will be deducted from your income at tax time, so it could offset some or all of what you owe from CERB, Damiani said. But unless you’re a whiz with these tax numbers, it’s best to get a financial advisor’s opinion on that strategy.

What if I just can’t save any money?

If the hope of some change to CERB’s tax status doesn’t come through, and you don’t have the money, your only choice will be to pay the taxes late.

If you do that, make sure you file your tax return on time, Devaney says ― because otherwise CRA charges a five per cent late fee, plus one per cent for every month the amount owed isn’t paid.

You can also arrange a payment schedule with CRA, Devaney noted, though they will still charge interest.

But he suggested the tax collector may be a little more lenient than usual next year.

“The CRA has encouraged applying for relief for late payments related to COVID-19 issues. However, this appears to relate only to filings in 2020. It is uncertain whether relief will be available, and under what circumstances, next year.”

RELATED

- Canada To Get Boost From CERB Paying Out More Than People Lost: Report

- CERB Will Be Extended 8 More Weeks, Trudeau Says

- Canada’s Jobless Rate Is Now Twice As High As Europe’s. Here’s Why.

- The Gaps In Canada's 'Social Architecture' Are Exposed. Now's The Time To Fill Them.

You May Also Like

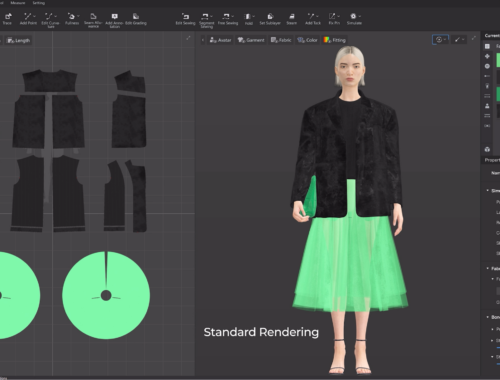

AI in Fashion: How Artificial Intelligence is Redefining Design, Production, and Shopping Experiences

February 28, 2025

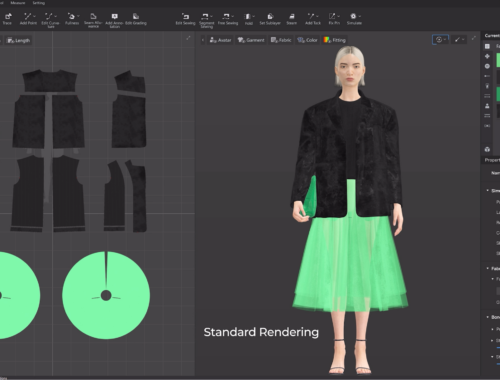

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025