Canadian Rental Rates Are Falling Fast Amid The COVID-19 Shutdown

MONTREAL ― It took a pandemic and an epic economic crisis to make it happen, but after years of rapid price growth, Canadians may finally get a bit of a break on the cost of housing.

With an estimated three in 10 working Canadians either losing their job or having their pay cut in the past several months, advertised rental rates are on a downward slide in many cities.

The average asking price for apartments nationwide fell 3.2 per cent in a month, to $1,842 per month for all housing types in April, according to data from rental portal Rentals.ca.

Condos rental rates fell by a larger 4.6 per cent, to $2,268.

Unfortunately, this comes at a time when most Canadians are in no hurry to go apartment hunting ― and when many others can’t make rent at all.

“With most of the country on lockdown, the majority of tenants are staying put for both financial and health reasons,” Rentals.ca said in a report issued this week.

“Many large landlords are staying firm on their asking rents, willing to wait out the pandemic, offering incentives like $500 off or a free month of rent. Smaller landlords appear to be more willing to lower their asking rent to attract the prospective tenants that are looking for apartments.”

According to data cited by CIBC economists, between 75 per cent and 90 per cent of Canadians paid their rent at the beginning of May, roughly in line with the percentage in April.

Things likely would have been worse had it not been for the federal Canada Emergency Response Benefit (CERB), which is providing $2,000 a month for up four months for those who have lost work in the pandemic, CIBC economist Benjamin Tal said.

“Despite the fact that most of the recent decline in employment is concentrated in low-wage occupations, the April collection rate was higher among low-income renters. … That can be explained by the availability of CERB money (which probably played a more important role in rent payments for May),” Tal wrote in a client note earlier this month.

RELATED

- Canada's Average Home Sale Price Falls 11% In A Month

- Pandemic Puts A Question Mark Over Future Of Canada's Cities

- Canada’s Renters, Homebuyers To Get A Break From Airbnb’s Flame-Out

Some of the priciest cities saw some of the steepest drops. One-bedroom units in Toronto fell 4 per cent in April from March, while two-bedroom units fell 7.7 per cent.

In Vancouver, one-bedroom units fell 5.6 per cent while two-bedrooms dropped a steep 15.8 per cent.

There is likely more downward pressure to come. With vacation travel at a standstill, owners of Airbnb units are putting their properties on the apartment rental market, causing a spike in new listings, Rentals.ca said.

“Because of COVID-19, Canada will have less immigration (and) fewer international students and, with the border closed, not nearly as many seasonal and part-time workers. All typically are renters,” the site said in a recent forecast.

“Reduced demand, and higher supply due to the conversion of short-term rental units to long-term rental units, will more than offset the reduced supply resulting from a lower completion rate (of new housing) … and weaker investment activity,” CIBC economists Benjamin Tal and Katherine Judge wrote in a report May 1.

Affordable housing in demand

But with so many households seeing shrinking incomes, “there will be more demand than ever for affordable housing,” Matt Danison, CEO of Rentals.ca, said in a report.

The owner-occupied housing market is also seeing falling prices amid the COVID-19 pandemic. Data released this week by the Canadian Real Estate Association (CREA) showed the average selling price of a home in Canada fell nearly 11 per cent from March to April.

Not all of that was the result of sellers lowering their prices. The slowdown appears to have hit the high end of the housing market harder than the rest. With fewer high-end sales in the mix, the average price has been dropping.

Click Here: All Blacks Rugby Jersey

You May Also Like

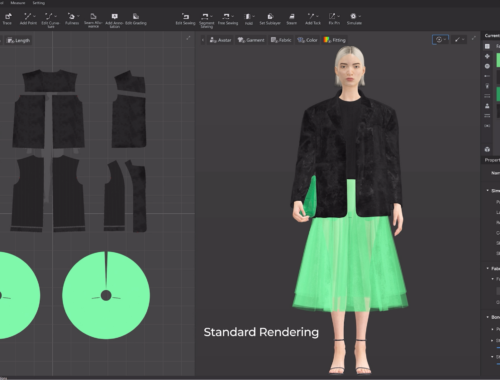

AI in Fashion: Revolutionizing Design, Shopping, and Sustainability for a Smarter Future

March 1, 2025

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025