Canadian Real Estate Investors Are Losing Money, Pose Risk To System: Veritas

MONTREAL ― A Toronto-based investment research firm has pinpointed what it sees as the key risk to Canada’s housing market: Money-losing investor-owners.

In an informal poll of its clientele earlier this month, Veritas found that only half of those who own real estate as an investment are cash-flow positive, earning more money than the property costs them.

About 18 per cent are breaking even, while 33 per cent said they are losing money on their investments. Presumably, they are counting on rising house prices to turn a profit; the Veritas survey showed 84 per cent of investors don’t plan on selling for now.

Watch: These Canadian towns are booming thanks to legal cannabis. Story continues below.

But if they do, it could be enough to turn the market downwards.

“Our belief is that house prices in the future will be driven by residential real estate investors, whether they are selling or buying,” Veritas said in a note to clients.

Click Here: Atlanta United FC Jersey

According to data from Statistics Canada released this year, about 38 per cent of condos in Toronto and 46 per cent in Vancouver are not occupied by their owners, meaning they are being rented out or are sitting empty.

And that trend seems to be intensifying. A report last year from CIBC estimated that about half of all condos delivered to market recently were bought by investors.

RELATED

- Liberal Victory Means A National Foreign Buyers' Tax

- Maritimes Rule (Yes, Really) In Ranking Of Canadian Housing Markets

- Is This The Real Reason You Can't Afford Rent?

“House price corrections happen when there is a flood of sellers,” Veritas said in its report. “In our opinion, the next flood will not come from a glut of new construction or even from owners, but from real estate investors and speculators.”

Veritas’ survey likely reflects the reality in Toronto more so than other Canadian markets. Fifty-four per cent of respondents own property in Greater Toronto, compared to 10 per cent in Greater Vancouver, 7 per cent in Montreal and 33 per cent everywhere else.

You May Also Like

コンテナハウスの魅力と活用方法

March 14, 2025

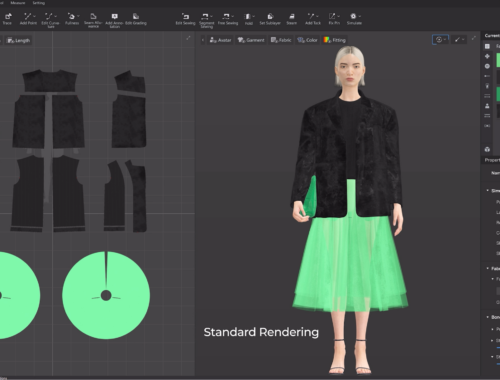

AI in Fashion: How Artificial Intelligence is Redefining Design, Production, and Shopping Experiences

February 28, 2025