Canadian Mortgage Rates Are Dropping After BoC's Big Rate Cut

TORONTO ― Several Canadian banks and financial institutions have dropped their prime lending rate by 50 basis points to 3.45 per cent, effective March 5.

The moves by the Royal Bank, Toronto-Dominion Bank, Scotiabank, Bank of Montreal, CIBC and the Desjardins Group match the Bank of Canada’s decision Wednesday to drop its key lending rate by 0.5 percentage points, which was itself a matching of what the U.S. Federal Reserve had cut a day earlier over the novel coronavirus.

The banks’ prime rates determine the interest rate on variable mortgages and home equity lines of credit (HELOCs), among other things. Borrowers of these types of loans will be paying less interest as part of their monthly payments.

Watch: Celebrities who’ve snapped up Canadian real estate. Story continues below.

The Bank of Canada said it cut its target for the overnight rate because COVID-19, as the virus is named, was “a material negative shock” to Canada’s already softening economic outlook.

The cut in the bank’s key rate is the first since the summer of 2015 and brings the rate to a level not seen since early 2018, while the bank had not dropped its rate by that much since the financial crisis.

Click Here: cheap nrl jerseys

RELATED

- Toronto House Prices Soar By $130,000 In A Year

- Feds Make Mortgage Stress Test Easier To Pass As House Prices Soar

- Guess What? Millennials Like Living At Home

The rate cut will make mortgages and other borrowing cheaper, but has also raised concerns it will further inflame already overheated housing markets.

Ratehub.ca says a homeowner with a five-year, $450,000 mortgage at a 2.6 per cent variable rate amortized over 25 years would save about $115 a month if the mortgage were to drop 0.5 percentage points to 2.1 per cent.

― With a file from HuffPost Canada

You May Also Like

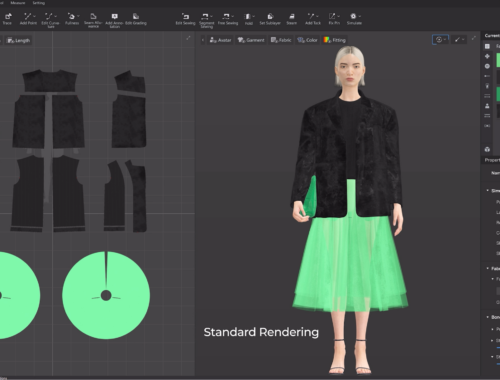

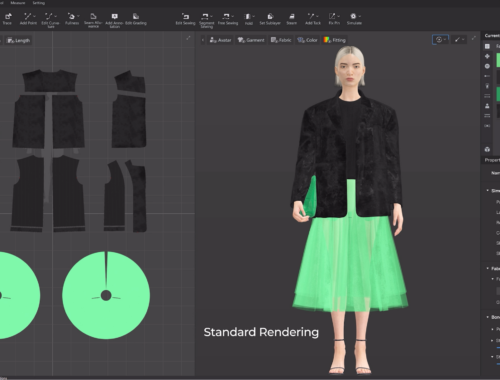

AI in Fashion: How Artificial Intelligence is Redefining Design, Production, and Shopping Experiences

February 28, 2025

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025