Canadian Household Wealth Is Diverging Along Urban-Suburban Lines

TORONTO ― The financial fortunes of Canadian households are diverging, and how you’re doing now depends in part on whether you live in the city or the suburbs.

In its annual Wealthscapes survey, Environics Analytics found urbanites did considerably better than suburbanites on household net worth in 2018. But it’s not that city cores have stronger economies or better job markets; rather, it has to do with real estate markets.

House prices in city cores have generally performed better than suburban real estate in the past few years, and that’s leading to a divergence in household net worth.

Watch: Tips for growing savings on a low income. Story continues below.

In Toronto, the average net worth of urban households grew by 0.6 per cent, to $959,946 in 2018, while in the suburban 905 region, net worth fell by 0.6 per cent, to $997,012 (numbers that obviously include the value of people’s homes).

Click Here: Ireland Rugby Shop

In Montreal, both city and suburbs saw a decline, but city dwellers did better holding on to their wealth, with net worth down 0.3 per cent, compared to minus-1.1 per cent in the suburbs. Vancouver was the one exception; wealth dropped in the city faster than it did in the suburbs.

This sort of thing can have an impact on the real economy, because of the “wealth effect”: people tend to spend more when they see they hold more wealth (even if they don’t necessarily have more cash to spend), and vice versa.

So why the divergence?

“Canadians are increasingly choosing the convenience of the urban lifestyle and effectively that’s why we’re seeing house prices creeping up in downtown cores while they’re more stagnant in the suburban areas,” said Peter Miron, senior vice president of research and development at Environics Analytics.

But additionally, the stock market decline at the end of last year had more of an impact on the suburbs, Miron noted, because suburbanites tend to be older, and older people tend to hold more savings in stock portfolios. The average stock portfolio lost 14.5 per cent in 2018, Environics reported.

RELATED

- Canada's Super-Rich Just Got Poorer, And Fast

- Incomes Up, Taxes Down For Canada’s Top 1 Per Cent, New Study Suggests

- Jagmeet Singh Says NDP Pledge To Take On The Super Wealthy

That may matter more to young Canadians than it used to. With housing affordability near historic lows, Miron says many younger Canadians are staying out of the housing market, and investing the money they would have otherwise saved up for a house ― particularly in Vancouver, one of the world’s least affordable cities for housing.

“When we look at these younger households, they’re choosing to rent a little longer, not hopping into the housing market either by choice or financial circumstance,” Miron said in an interview with HuffPost Canada.

“But it’s not like they’re blowing their money. They’re actually saving up those liquid assets, and finding other ways to save their money.”

You May Also Like

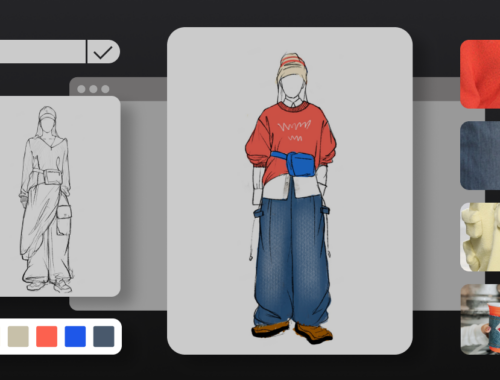

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025

Pool Products: Essential Accessories for Your Swimming Pool

March 17, 2025