Canada's Housing Market: The Biggest Moments Of 2019

Another year is behind us, and a new decade is being ushered in. As 2019 winds down, predictions for the 2020 housing market are in full swing: Will mortgage rates sink lower? Will newly energized markets heat up further? How high will prices climb in Canada’s biggest cities?

With a federal election wrapped up and new policies and proposals on deck, 2019 was a significant year for Canadian homebuyers. Here, we look back at some of Canadian real estate’s biggest moments from the last 12 months.

From a white winter, to a white-hot spring

Canada’s real estate market kicked off the new year in painfully slow fashion before finally turning a corner in the spring.

The stricter mortgage stress test, implemented a year prior, combined with a sluggish economy, left the market feeling “hung over” in the first quarter of 2019, leading some industry experts to predict a slow-moving year overall. Vancouver was among the hardest-hit cities, seeing a near 35-per-cent decrease in sales in February compared to the same period a year prior.

Watch: These four Canadian homes will blow your mind. Story continues below.

Finally, come early spring, the market started to make a comeback as sales slowly climbed. Toronto led the charge into the spring market as the first city to see major post-winter improvements. In May, the Toronto Real Estate Board (TREB) reported an 18.9-per-cent increase in sales and saw the average detached home price increase annually for the first time in several years. Throughout summer, Toronto continued to speed ahead, with strong year-over-year price and sales growth. In June, the average price of a home jumped three percent across the GTA as 8,860 residences changed hands.

Toronto’s condo market in particular played a large role in the post-winter recovery, seeing an 11.1-per-cent increase in sales and a 5.8-per-cent boost in prices in the third quarter. A late bloomer, sales in B.C. finally flickered back to normal levels by October as 7,666 home sales took place across the province, a 25.4-per-cent increase from the same period a year prior.

Selling homes like hotcakes in Montreal

While other major markets struggled in early 2019, Montreal held its own steady course throughout the year. Data from the Quebec Professional Association of Real Estate Brokers’ (QPAREB) show solid increases in prices and sales across the year for Quebec’s biggest city. The summer market was particularly strong, to the benefit of Montreal home sellers, with the sales-to-new listings ratio reaching 97 per cent in June.

However, it’s unclear how long this trend can be maintained — a scarcity in new listings is putting pressure on this historically affordable housing market.

A little help from your friend, Justin

The Liberals’ federal budget, unveiled in March, promised to give prospective first-time buyers a much-needed leg up. Through the Canada Mortgage and Housing Corporation (CMHC), this new policy allows first-time homebuyers to participate in a shared-equity mortgage program, called the First-Time Homebuyers’ Incentive. The program permits households with qualified annual incomes under $120,000 to receive between 5 and 10 per cent of the cost of their home’s value in down-payment assistance, in exchange for a corresponding equity stake.

First-time buyers were also helped out through an increase to the amount they’re able to withdraw tax-free from their RRSP to purchase a home.

While the First-Time Homebuyers’ Incentive was lauded for making housing more affordable, it was criticized for failing to meet the needs of buyers in the country’s most expensive markets. For instance, hopeful purchasers in Toronto and Vancouver won’t have much use for it in its current incarnation. The equity program requires that the insured mortgage, in addition to the applied incentive, not surpass four times the purchaser’s household income, a limit of $480,000, disqualifying many buyers in Canada’s high-priced cities. During their re-election campaign, the Liberals announced that they would expand the program to assist buyers in pricey markets — the maximum income to qualify would be raised to $150,000, along with the total mortgage value, which would be increased to $750,000 for specific cities.

More stressing over the stress test

Critics of the First-Time Homebuyers’ Incentive pointed to relaxing the mortgage stress test and returning 30-year mortgage amortization periods as a way to support struggling aspiring homebuyers.

One such voice was the soon-to-be former official opposition leader Andrew Scheer, then running in the federal election campaign against Justin Trudeau’s Liberals. Scheer also proposed modifying the stress test to remove the requirement that mortgage renewal applicants must requalify under the stress test.

A coalition of red and orange

The Liberals held onto power with a diminished minority government, but pushing their housing agenda through the House of Commons will need the support of the NDP. The majority threshold is 170 seats — with the Liberals at 157 seats and the NDP at 24, the parties will need to work together to push through the Liberals’ legislative desires.

While the NDP and Liberals enthusiastic about improving housing affordability, their suggestions on how to do so vary.

RELATED

- Can’t Afford A House In A Red-Hot Market? Co-ownership May Be The Answer

- 4 Canadian Tiny Vs. Mega Homes That We're All Dreaming About

- There Haven't Been This Few Homes For Sale In Canada Since 2007

The Liberals want to continue to build upon their First-Time Homebuyers’ Incentive plan that they unveiled in the 2019 federal budget, expanding the program to include buyers with higher income levels and bigger mortgage sizes. The NDP would prefer to bump maximum mortgage amortizations up to 30 years — an election promise also touted by the Conservatives — specifically for first-time homebuyers. In an assertive approach to tackle low housing supply, the NDP also campaigned on their intentions to build 500,000 affordable housing units over 10 years, introduce a national 15-per-cent home purchase tax for non-citizens and create rental subsidies.

After the Liberals’ First-Time Homebuyers’ Incentive was criticized for inadequately accommodating buyers in expensive urban communities, it remains to be seen how effective any future policies from these two parties will be.

Low and slow mortgage rates

After an aggressive 15-month period of rate hikes, the Bank of Canada didn’t move its mortgage-market influencing overnight interest rate this year, keeping it at 1.75 per cent, where it’s now sat since October 2018. Prior to this halt, the central bank had steadily upped the policy rate by 25 basis points on five separate occasions since July 2017.

Though there was talk of a rate cut in fall 2019, it seems that Canada’s strong labour market and recovering housing sector is causing the bank to wait for further evidence of economic instability before cutting rates again. While the bank is on hold for now, some economists are predicting that mortgage rates will sink even further in 2020. The BoC will also see new leadership — governor Stephen Poloz has announced that he’ll be stepping down in 2020 and not seek a second term in the post.

This story originally appeared at Livabl.

You May Also Like

HOW TO PREVENT MOLD AND MILDEW ON TRUCK TARPAULINS?

November 22, 2024

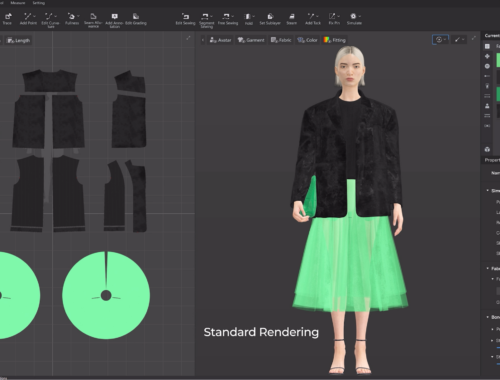

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025