Canada’s House Prices Are Soaring Because Reality Doesn’t Matter Anymore To Things Like That

Many people have been scratching their heads lately trying to understand how it is that Canada’s average house price jumped more than 17 per cent during the worst economic crisis to hit the world in decades. On its face, it seems senseless.

There is an answer, but to get to it, you have to learn the same uncomfortable lesson that the head of Canada Mortgage and Housing Corp. (and some of us who write about economics) learned this year. And that lesson is that we are living in an illusion created by central bank money-printing and profligate government spending. If house prices seem detached from reality, it’s because they are.

Earlier this year, as the first wave of the pandemic unfolded, Evan Siddall, head of the government-run CMHC, found himself in a war of words with some members of the real estate industry. They were upset at Siddall’s prediction of a house price decline of 9 to 18 per cent in Canada this year, as a result of the economic shock from the pandemic.

Watch: British home sales hit record after slowdown. Story continues below.

The real estate agencies, and some economists at the major lenders, didn’t see it that way at all. Some came out with forecasts boldly predicting a rise in house prices amid the crisis, including a prediction of a 6-per-cent jump from TD Bank.

Now we see the industry’s forecasts were not only right, they massively underestimated the housing boom seen in recent months. So how did CMHC, essentially a government agency, get it so wrong? After all, Siddall’s prediction seemed like common sense, given the circumstances.

CMHC’s mistake was that they were approaching the housing market as if it’s still tethered to reality ― that is, the reality of the people in the housing market. They were looking at the unemployment rate, household debt levels, wage levels, mortgage rates ― the “basic ingredients” of house price changes.

RELATED

- Toronto’s Sudden Deluge Of Condos For Sale Is Bad News For Investors

- 2/3 Of Young Canadians On Brink Of Insolvency But Homeowners See Wealth Soar

- Canadian House Prices, Housing Inequality Set To Jump, Experts Say

- Pandemic Pushing Down Rent Prices In Toronto, Vancouver

But the people who got it right were looking at something else. They understood that house prices today are made from a completely different recipe. They were looking at the shadowy reality of our financial system, where the Bank of Canada this spring began a program of “quantitative easing” ― essentially printing money, which it then used to buy government and other kinds of debt.

By doing so, it pushed down interest rates, making it more affordable for the federal government to run up a dizzying deficit amid the pandemic, and also driving down mortgage rates for buyers.

The federal government used this cheaply-borrowed new money for a series of emergency income support programs that paid out considerably more than the income people lost.

“Overall, Canadian households received more money ($56 billion) from government aid programs such as CERB and other transfers in the second quarter than they lost in wages and salaries due to the pandemic ($23 billion),” Royal Bank of Canada economist Robert Hogue wrote in a report this week.

“On net, household disposable income spiked 11 per cent in Canada. This substantially increased (home) buyers’ purchasing power.”

The forecasters who saw higher prices knew cheaper mortgages were on the way, and they also remembered a simple-enough lesson from the U.S. Federal Reserve’s money-printing operation a decade ago, during the Great Recession: the rich got richer.

There was a massive run-up in equity prices ― stocks, bonds and real estate ― that largely benefitted the people who own stocks, bonds and real estate.

From a big-picture perspective, the massive central bank money-printing and government debt-spending has papered over the entire pandemic-related economic crisis, turning our economy into a Potemkin village where stock prices soared to record highs even amid the steepest economic slowdown in decades, and where house prices soared by double digits even as every homeowner’s future was thrown into doubt.

And in the pandemic lockdowns, the people who took the biggest hit were lower-income earners working in service and high-contact jobs. Those are not the people who tend to buy houses, the housing optimists noted. They ignored the fact that Canada lost some 3 million jobs this spring ― and were proven right.

Bailout not needed

Fearing a potential housing market crash, CMHC extended a massive $150-billion bailout to mortgage lenders this spring, offering in effect to buy any insured mortgage a lender wasn’t comfortable carrying on their books.

According to CMHC’s published data, the agency bought $5 billion worth of mortgages in its first purchase operation in April. It bought $806 million in the second round, and $10 million the third round in May. Since then, it has been zero. No one has been dumping bad mortgages on CMHC, and the agency plans to wind the program down in December.

“If anything, that might be a vote of confidence in the financial system,” said David Larock, an independent mortgage broker who blogs at Integrated Mortgage Planners.

As far as Larock is concerned, the CMHC’s lifeline, as well as the Bank of Canada’s emergency purchases of Canadian mortgage bonds (which are also coming to an end) were “a big nothingburger” in terms of their impact on the market.

What’s more ― and in a further sign of how detached from reality the housing market is becoming ― Larock predicts good news for homebuyers in the form of even lower mortgage rates ahead.

Believe it or not, Larock says Canada’s rock-bottom mortgage rates are actually higher than they should be, because borrowers have been paying an additional “Covid risk premium” due to uncertainty over the future of the market.

Now that everyone knows the government and the Bank of Canada won’t allow the housing market to tank, “the Covid risk premium will melt out of the market,” he says.

All the government spending and central bank printing means “ultimately, we haven’t seen what the effect of Covid is yet,” he adds.

“The government can’t afford to keep doing what it’s done…. (But) as long as rates stay as low as they are now, then we can afford to service it. That’s what convinces me more than anything that rates aren’t going higher. They simply can’t.”

Even so, Larock sees tough times for the condo market. Investor owners are having a harder time renting out their units, and the math isn’t working for many of them anymore. The supply of condos for sale has spiked in recent weeks in many cities, into territory that suggests a slowdown ahead.

Jittery about the U.S. election, stock markets have turned negative in recent weeks. And the second wave of Covid-19 has some economists whispering about the economy stalling towards year’s end.

So maybe reality will make an ugly comeback yet. In the meantime, our stock markets and house price reports will likely continue to look like we live in the best of times.

U.S. Election Results Live

Latest results plus breaking news and analysis from HuffPost reporters in the U.S. and around the world

See More

Click Here: NRL Telstra Premiership

You May Also Like

FACTORS AFFECTING THE SERVICE LIFE OF GEOTEXTILES: DURABILITY AND MAINTENANCE

December 9, 2024

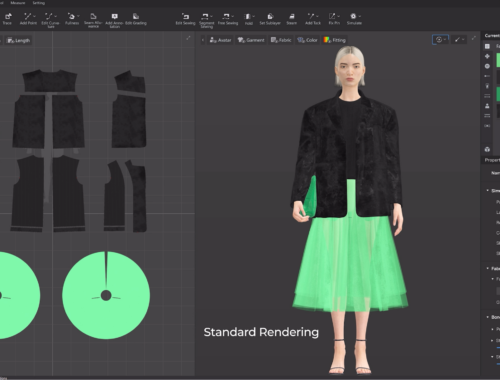

AI in Fashion: Revolutionizing Design, Shopping, and Sustainability for a Smarter Future

February 28, 2025