Good moral behavior key to better credit for villagers

Businessman Sun Yueqing has been volunteering on a “moral jury panel” – which helps local financial institutions decide how much credit should be made available to villagers based on their moral practices.

Sun and 14 other members on the panel in Rongxing village in Tongxiang, Zhejiang province, base the credit on whether one has maintained good relationships with neighbors, spouses or parents-in-law, or kept front yards clear of garbage. A rating from one to five stars becomes a factor determining the amount of credit available to each of the 2,548 villagers, ranging from 50,000($7,200) to 300,000 yuan.

This is the first time rural residents, mostly farmers unable to provide a verifiable source of income, can get loans from official financial institutions without any guarantee or mortgage, according to Zhejiang Provincial Department of Agriculture and Rural Affairs.

The project, titled “benefiting farmers financially”, is part of the rural revitalization strategy implemented by Rongxing village and then expanded to the whole city of Tongxiang earlier this year. The village, with several others in the province, was recently selected and promoted as an archetype for the rural revitalization strategy, which was made a priority by the Central Committee at the Communist Party’s 19th National Congress.

According to Pang Wei, a researcher with the Provincial Department of Agriculture, what distinguishes the village is not only the project, but the system that makes the project possible.

Click Here: cheap kanken backpack

Since 2013, Tongxiang has encouraged its villages to combine “self-rule”, “rule by law”, and “rule by moral standards” into the rural management system.

“For thousands of years, China’s rural communities were built on the special connections between acquaintances. For many rural residents, the opinions of a neighbor, a senior villager, or a generally acknowledged gentleman matter as much as the law or the orders from the government. Therefore, financial credit in rural regions could be re-evaluated through the system,” said Pang.

A total of 79,148 rural households in Tongxiang have been granted 13.4 billion yuan in credit by the end of May, according to the city government.

Individuals who get the loans can use the money for private purposes like preparing for the wedding of their offspring, renovating their residences or for the expansion of their agricultural production. Investment in the stock market or real estate is not allowed.

You May Also Like

Automatic Weather Station: A Comprehensive Overview

March 14, 2025

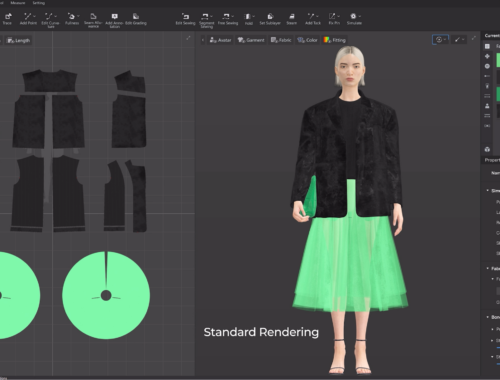

AI in Fashion: Revolutionizing Design, Shopping, and Supply Chains

February 28, 2025