China can withstand fallout from trade tensions

Nation’s supportive monetary policies, fiscal stimulus will pay off, say experts

The Chinese economy can “surf through” the tide of Sino-US trade tensions, as both broad-based and targeted measures to stabilize growth will pay off, said senior economists at Netherlands-based global financial institution ING Bank NV.

“Holistically, China can weather and surf through the trade tensions because it has the fiscal stimulus and supportive monetary policies already in place,” said Iris Pang, director and economist of ING in China.

With the planned proactive fiscal measures being pushed at a good speed, the Chinese economy is set to grow steadily at about 6.3 percent this year, Pang told China Daily.

The Chinese authorities are implementing this year’s plan to cut nearly 2 trillion yuan ($289.8 billion) worth of taxes and fees, as well as to fund 2.15 trillion yuan worth of infrastructure investment through local government special bonds.

The 4 trillion-yuan stimulus package – equivalent to approximately 1.7 percent of China’s nominal GDP – is of a large scale, and will help offset the drag of trade tensions on growth, Pang said.

“I don’t think China needs any more broad-based stimulus,” Pang said, adding that it is important not to overdo the stimulus and instead “save the bullets” for potential worse-case scenarios.

During the first quarter, the world’s second-largest economy grew by 6.4 percent year-on-year, unchanged from the previous quarter, according to the National Bureau of Statistics. In April, the economy remained stable but cooled modestly, with growth in industrial output and retail sales down from March.

“The Chinese economy is performing adequately in difficult circumstances (caused by the trade tensions),” said Robert Carnell, chief economist and head of research of Asia-Pacific at ING.

Though the economy as a whole will be on an even keel, some private and small exporters have been hurt by the US tariffs and may shut shop, which will weigh on employment stability and consumption, Carnell said.

Making sure the private sector withstands the trade tensions is essential, only by which the economy can keep driving itself forward, said Carnell.

Targeted monetary policies have been stepped up to lend a hand to the private sector, which are “being done in a methodical and considered way that I think is ultimately going to help”, he said.

On May 15, the People’s Bank of China started a three-step plan of cutting the reserve requirement ratio (RRR) of small and medium-sized rural commercial banks, a move that will free 280 billion yuan for loans to small private companies.

The central bank has also adopted its new instrument – targeted medium-term lending facility (TMLF) – twice this year, lending more than 500 billion yuan to commercial banks that “have the potential of increasing loans for small and micro enterprises and private enterprises”.

More targeted RRR cuts and TMLF injections may be on the way, Pang said, adding that other policy support for small exporters can also be expected, such as export rebates and measures to facilitate exports to economies involved in the Belt and Road Initiative.

In the longer term, Pang expects the Chinese economy to maintain a GDP growth rate of about 6 percent for the next decade, with the development of 5G-related industries an important driver.

The superfast wireless technology will bring “revolutionary changes” to both the Chinese and the world economy, like the evolution from “gas light to light bulb”, Carnell said.

For instance, 5G will not only bring about new demands such as for streaming and gaming, but also change economic tenets as marginal costs for production may drop to zero under some circumstances, he said.

Pang said China is expected be more advanced than many other economies in terms of 5G development, as the country had started related investments earlier. Meanwhile, against the backdrop of trade tensions, it should strive to become more self-sufficient in the sector, she said.

China may grant official 5G licenses to telecom carriers this year and is likely to start commercial use of the technology nationwide in the near future, possibly as soon as October, people familiar with the matter said recently.

Jiang Xueqing contributed to this story.

You May Also Like

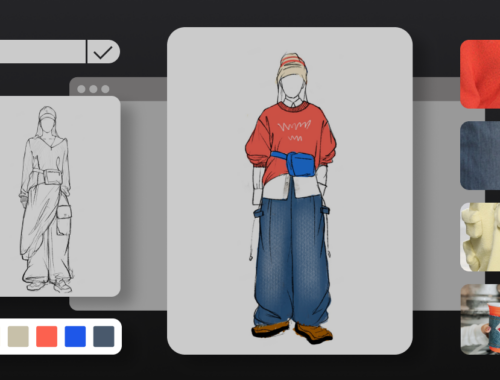

Revolutionizing Fashion: How AI is Redefining Design and Sustainability

March 1, 2025

The Future of Fashion: How Artificial Intelligence is Revolutionizing the Industry

February 28, 2025