On climate change, oil and gas companies have a long way to go

This story is part of Covering Climate Now, a global journalism collaboration strengthening coverage of the climate story.

The oil and gas industry has found itself under a harsh spotlight as concern over climate change increases across the world. Lately, oil and gas majors have responded to the scrutiny with a series of pledges, plans, and press releases on the subject of global warming. The big five oil giants — Exxon and Chevron (US), BP (UK), Total (France), and Shell (the Netherlands) — have all pledged, with varying degrees of ambition, to reduce their emissions.

The industry has clearly gotten the memo that climate policy is happening. And it wants to be at the table rather than on the menu.

But do these pledges pass muster? Are they in line with a 1.5° Celsius scenario, or even close? The general consensus seems to be no. The International Energy Agency said, upon this year’s release of its “Oil and Gas Industry in Energy Transitions” report, “there are few signs of the large-scale change in capital allocation needed to put the world on a more sustainable path.” In other words, show me the money.

There are other ways of assessing these plans outside of their total dollar amounts. Do they rely on carbon offsets or carbon capture plans of dubious value? Do they signal a change in lobbying, advertising, and political participation? Do they account for climate justice?

In an attempt to bring some rigor to these assessments, the nonprofit Oil Change International (OCI) has released a report that lays out a set of necessary-but-not-sufficient “minimum criteria” that oil company plans must meet “to have the possibility of being 1.5°C-aligned.”

How do the plans measure up? Well, they all fail — none are aligned with 1.5°. BP is doing the best, but none are particularly close to clearing the bar.

Before getting into the criteria OCI uses and what they say about oil company pledges, let’s run through a little background.

The fossil fuel industry is struggling with low prices, oversupply, and political pressure

As I wrote in some detail earlier this year, the fossil fuel industry is a mess. It was facing difficult cross-pressures even before the Covid-19 lockdown hit it in the gut.

Fracking operations have been losing money for years. Overproduction and overinvestment have created a supply glut that was suppressing oil prices even before the virus struck. Renewables are skyrocketing and electric vehicles (EVs) are poised for enormous growth, both of which will cut into future oil demand.

Oil majors have been writing down assets, financial institutions are turning away from oil investments, and plastics are likely to substantially underperform the industry’s rosy projections. All the while, customers, corporate partners, investors, shareholders, and activists are putting ever-increasing pressure on oil and gas companies to begin planning seriously for climate change.

This was all going on when the coronavirus hit and cratered demand, which still hasn’t recovered and may never fully recover. Some analysts are speculating that 2019 will turn out to be the global peak in fossil fuel demand. “Could it be peak oil?” speculated BP CEO Bernard Looney. “Possibly. I would not write that off.”

Meanwhile, the decline continues. This is the context in which these commitments are being released: Oil and gas companies are somewhat desperate, unusually weak, and badly need social capital.

To limit global temperatures to 1.5°, most oil and gas must stay in the ground

Previous OCI research has compared known fossil fuel reserves to the carbon budget permitted by a 1.5° scenario. The situation is stark.

Fossil fuel companies have what are called “proved reserves,” which are fields that can be reasonably expected to produce in current economic conditions, and “developed reserves,” which are fields that are currently producing, through existing mines or wells.

If fossil fuel companies develop all their proved reserves, the 2° carbon budget would be blown many times over. In fact, as the graph below shows, developed reserves alone would blow the 2° budget. In fact, if every coal mine in the world vanished overnight, the developed reserves of oil and gas would still push past the 1.5° budget.

Developed reserves are what analysts call “carbon lock-in” — the carbon hasn’t been emitted yet, but investments in infrastructure, equipment, and labor make it extremely difficult, politically and economically, to prevent it from happening.

Every bit of new fossil fuel exploration and development, every new mine or well, is an increment of carbon lock-in. And since there’s no carbon budget left over, the only way to truly get on a 1.5° path is to cease exploring or developing new reserves entirely.

That is the baseline: The growth of fossil fuels is incompatible with solving global warming. Acknowledging that basic fact is the beginning of any serious plan for oil and gas companies.

With that in mind, let’s take a look at OCI’s assessment.

Oil companies are doing a fraction of what they need to do to get in line with 1.5°

OCI lays out 10 minimal conditions that must be met for a plan to be aligned with 1.5°, which it applies to eight of the biggest integrated oil and gas companies in the world: BP, Chevron, Eni, Equinor, ExxonMobil, Repsol, Shell, and Total.

The conditions fall under the headings Ambition (1-5), Integrity (6-8), and Transition Planning (9-10). We’ll walk through them and cite companies (if any) that are meeting them.

- Stop exploration: no more finding new fields. BP is the only company that has agreed to this, and only in new countries.

- Stop approving new extraction projects. No company has pledged this.

- Decline oil and gas production by 2030. BP has said it will reduce production 30 percent by 2030; Eni has said it will plateau in 2025, but only oil will decline. Other companies have said nothing.

- Set long-term phase-out plan aligned with 1.5°C. BP, Eni, and Repsol have plans OCI deems insufficient; the rest have none.

- Set absolute target covering all oil and gas extraction, including scope 3 emissions. Where scope 1 and 2 emissions are direct energy use by a company, scope 3 emissions encompass the entire supply chain through which the company’s products are produced and used — in this case, the carbon emitted by burning fossil fuels. Eni and Repsol are good on this. Equinor, Shell, and Total cover scope 3 emissions, but only through carbon intensity targets rather than absolute reductions. BP is good on the surface, except it contains some pretty big loopholes. Its pledge “excludes more than 40 percent of its oil production and 15 percent of the gas that come from its stake in the Russian energy giant, Rosneft,” Nicholas Kusnetz reports for Inside Climate News. “It also excludes all the oil and gas that BP’s refineries and service stations buy from other producers before selling it to customers.” Plus, BP recently announced that it’s selling a large chunk of oil and gas assets, which will get them off BP’s books, but will not shut them down.

- Do not rely on carbon sequestration or offsets. They all do, though.

- Be honest about fossil (“natural”) gas as high carbon. None of them are, though. Lots of them are still passing it off as a “low-carbon” shift.

- End lobbying and ads that obstruct climate solutions. Here, BP, Eni, Equinor, Repsol, Shell, and Total have all made vaguely positive noises that OCI deems insufficient.

- Commit to explicit end date for oil and gas extraction. None of them have.

- Commit plans and funding to support workers’ transition into new sectors. None of them have.

Here’s the visual — if you can’t read it, just note all the red, which means “grossly insufficient.”

One thing worth noting: The only two companies with solid red all the way down are Exxon and Chevron, the US companies. They, like the country they call home, are laggards on climate.

While almost all the companies are planning increases in oil production, Exxon and Chevron are planning the most:

Exxon and BP are planning the biggest increases in gas production:

In general, the European oil and gas majors are farther ahead on climate change, likely because the political context in which they operate takes climate change more seriously. But none of the majors are even beginning to make the enormous near-term shifts in investment that will be required to hit their long-term targets.

The oil majors have a long journey ahead

OCI’s criteria are quite strict and no oil and gas major is anywhere close to meeting them. There is an entire section of the report on the various loopholes the majors are using to diminish or minimize accountability, from ignoring scope 3 emissions (side-eye at Exxon) to making unreasonably big bets on unproven carbon capture technologies to measuring carbon intensity rather than absolute emissions.

And of course, the fossil fuel companies, despite their rhetoric, continue to put their lobbying power behind campaigns and trade groups that oppose climate action.

“In 2018, for example, BP played a central role in blocking the adoption of a carbon tax in Washington State, spending $13 million to help defeat the effort,” Kusnetz writes. “BP, Chevron and [the American Petroleum Institute, an industry trade group] all supported the Trump administration’s weakening of regulations limiting methane emissions from oil and gas operations. The institute has also pressed lawmakers and governors to eliminate incentives for electric vehicles, policies that are among the few in the United States that encourage a shift away from oil.”

During the pandemic, the industry has lobbied furiously for special breaks and favors to boost production and prices. And it has largely received them, especially from Trump. A recent Morning Consult analysis found that the US “has committed more to fossil fuel companies through federal and state policies than any other Group of 20 member has directed to all energy types — fossil and renewable combined — since the start of the pandemic, both through relief packages and other, ostensibly unrelated, policy changes.”

By and large, fossil fuel companies are fighting for their narrow interests within the system they find themselves, which is pretty much what you’d expect them to do.

A few of the European majors are beginning to budge. Here’s Kusnetz again:

BP and Shell insist they are now aligning their lobbying with their net-zero goals. Shell, at least, has begun to back this up: The company opposed the Trump administration’s methane regulation roll-back and the loosening of fuel efficiency standards for cars. Shell and BP also have announced they will leave the American Fuel and Petrochemical Manufacturers, a trade group, because of its opposition to carbon taxes and its failure to support the Paris Agreement. In February, BP said it would end its “corporate reputation” advertising, and that any future campaigns would “push for progressive climate policy; communicate our net zero ambition; invite ideas; or build collaboration.”

That’s a good start, but there’s a long way to go and a lot of companies that aren’t yet on board.

OCI’s criteria, if met, would effectively amount to the rapid managed phase-out of enormous assets by the industry that controls the assets, a transition not every company, or even most of them, would survive. That is not something that typically happens. A moment’s consideration leads to the conclusion that headlines the final section of the report: “Oil and gas companies will not manage their own decline.”

In that sense, the report is something of a thought experiment, meant to reveal what ought to be obvious, as OCI says: “Governments must step in to manage the decline in fossil fuel production and secure a just transition.”

Ultimately this is a matter for public policy. The system in which oil and gas companies operate must be changed, to channel investment away from fossil fuels into alternatives and affected communities. That will happen, if at all, through organization, democratic pressure, and changes in legislation and regulation — not through voluntary pledges.

You May Also Like

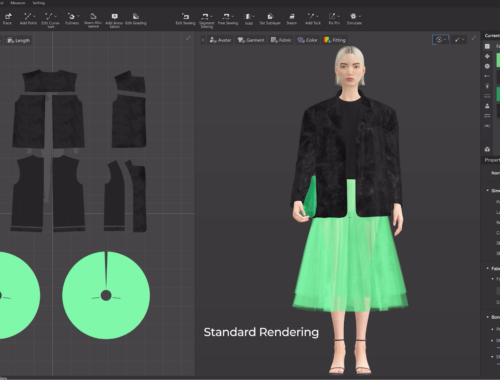

AI in Fashion: Revolutionizing Design, Sustainability, and Shopping Experiences

February 28, 2025

Sprunki: Unveiling the Mysteries of a Hidden World

March 20, 2025