5/13 WWE Stock Track – how did Financial Week finish out?

>

PWTorch editor Wade Keller presents a special Thursday Flagship edition of the Wade Keller Pro Wrestling Podcast featuring a WrestleMania 36 Preview with ex-WWE Creative Team member and professional stand-up comedian Matt McCarthy.

(Search “wade keller” to subscribe in podcast app or CLICK HERE to subscribe in Apple Podcasts.)

WWE Stock Track 2016

Week 18 – May 9-13

– Friday, May 13: Closing Price of $17.93 per share, up half-a-percent from Thursday.

The stock settled down on Thursday and Friday after nearing a year-high on Wednesday.

Friday’s peak was $18.40 per share, getting close to the mid-$18s before settling below $18 to close the week.

Overall, WWE started the week at $17.13 per share, climbed as high as $18.82 on Wednesday the day after their latest financial report, and dipped below $18 to finish the week.

WWE is now valued at $1.36 billion, up from $1.30 billion at the start of the week. This is up from the 2016 starting point of $1.34 billion.

Click Here: liverpool mens jersey

– Thursday, May 12: Closing Price of $17.79 per share, down 1.6 percent from Wednesday.

The stock climbed as high as $18.31 per share.

– Wednesday, May 11: WWE’s stock price neared the highest point of 2016 the day after the company reported quarterly financial results.

Investors liked WWE’s report enough to raise WWE by 3.7 percent on Wednesday. WWE’s stock closed at $18.08 after finishing at $17.43 on Tuesday.

The stock climbed as high as $18.82 per share, nearly reaching the previous high of $18.93 in March.

This was the highest the stock has been since reaching $18.86 on April 4, the day after WrestleMania when WWE released Network subscriber figures. The stock quickly fell off when investors were mixed when digesting the results.

This time around, investors seem to be bullish on WWE’s stock after processing the First Quarter earnings report.

– Tuesday, May 10: It was an interesting financial day for WWE reporting First Quarter 2016 earnings.

The end result was a closing price of $17.43 per share, up two percent from Monday. It’s a sign of investor confidence since recent quarters have resulted in big sell-offs indicating that investors were not confident in WWE’s business outlook.

WWE wanted more, though. The stock climbed as high as $18.25 and traded in the $18s for most of the afternoon before falling off in the final two hours to finish at $17.43.

It was a disappointing finish for WWE, which was looking at 5-7 percent growth for most of the day until settling for two percent.

The investment community was bullish on WWE after the financial report, looking at Q1-2016 having a solid quarter against Q1-2015, which included WrestleMania business. Investors also looked ahead to what should be a favorable Q2-2016 when this year’s WrestleMania business is reported.

There still seems to be concern about WWE Network growth despite financial executive George Barrios’s bullish outlook during the quarterly conference call. WWE is predicting 1.5 million average paid subscribers when they report Q2, which would represent a significant increase from rounded 1.3 million in Q1.

– Monday, May 9: Closing Price of $17.06 per share, down half-a-percent from $17.13 last Friday.

The stock fell as low as $16.80 per share during the morning trading session. After lunch, the stock climbed back to $17.20 before settling at $17.06 heading into Tuesday’s First Quarter financial results.

2016 WWE STOCK SCORESHEET

2016 Open: $17.44 per share

Latest Close: $17.93 per share (5/13)

Current 52-Week Range: $13.15-23.63

2016 High Points: $18.93 (3/17), $18.86 (4/4), $18.82 (5/11), $18.42 (1/26)

2016 Low Points: $14.20 (2/11); $15.55 (4/12)

2016 Initial Market Value: $1.34 billion

Current Market Value: $1.36 billion (5/13)

2016 Market Value Low Point: $1.11 billion (Week of 2/8)

2016 Market Value High Point: $1.39 billion (Week of 3/28)

Feb. 11: Financial Day #1 Milemarker (Q4 & 2015 Year-End): $14.94 closing price (down 5.1%)

May 10: Financial Day #2 Milemarker (First Quarter 2016): $17.43 closing price (up 2.2%)

You May Also Like

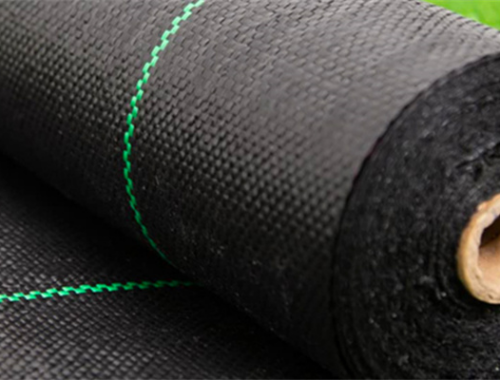

FACTORS AFFECTING THE SERVICE LIFE OF GEOTEXTILES: DURABILITY AND MAINTENANCE

December 9, 2024

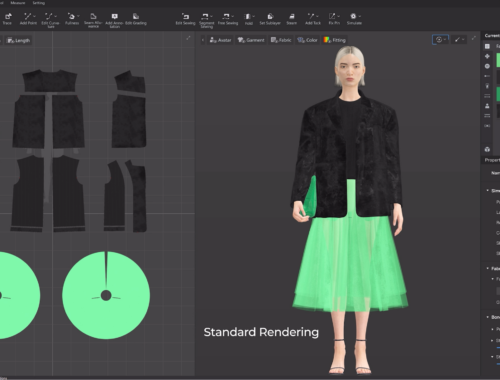

AI in Fashion: Revolutionizing Design, Shopping, and Supply Chains

February 28, 2025